The Asian Bankers Association (ABA) and the Philippine National Bank (PNB) co-hosted the webinar on “Philippine National Bank: National economy and banking environment” on 10 April 2025 aimed at sharing PNB’s institutional initiatives and insights on the Philippine economic outlook for 2025.

The Asian Bankers Association (ABA) and the Philippine National Bank (PNB) co-hosted the webinar on “Philippine National Bank: National economy and banking environment” on 10 April 2025 aimed at sharing PNB’s institutional initiatives and insights on the Philippine economic outlook for 2025.

Moderated by Mr. David Jimenez Maireles, Qorus’ Digital Payment Expert, the one-hour session featured the presentations of Ms. Jennifer Ng, PNB Senior Vice President and Head of Marketing, and Mr. Alvin Arogo, PNB First Vice President and Head of the Research Division. The webinar gathered 326 registrants from 28 countries.

SUMMARY

(1) Ms. Jennifer Ng, PNB Senior Vice President and Head of Marketting

Ms. Ng provided an overview of PNB’s legacy as a universal bank with over a century of service, highlighting its robust domestic presence and international network supporting Overseas Filipino Workers (OFWs). She emphasized PNB’s evolving role in promoting financial inclusion through digital transformation, strategic marketing, and specialized outreach to underserved sectors, including MSMEs. The Bank’s initiatives include tailored financial education campaigns, simplified credit access, and digital tools designed to address the specific needs of OFWs and entrepreneurs. These efforts aim to deepen customer engagement and broaden service accessibility across economic segments.

(2) Mr. Alvin Arogo, PNB First Vice President and Head of the Research Division

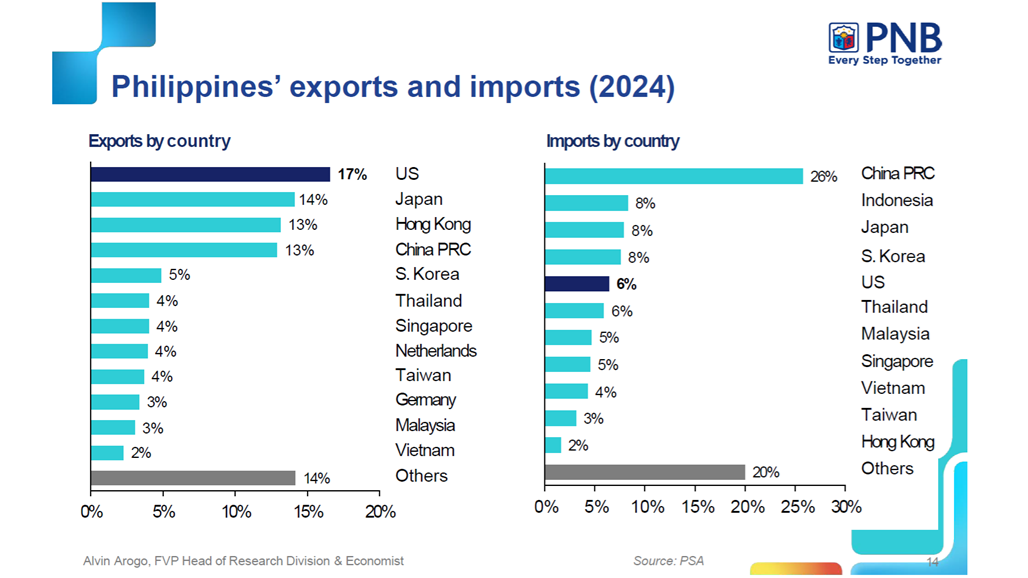

Mr. Arogo followed with a briefing on the Philippine economy, forecasting a 6.2% GDP growth for the Philippines in 2025. He attributed this outlook to resilient domestic consumption, sustained infrastructure spending, and healthy foreign remittance inflows. He said that inflation is expected to remain within the central bank’s target range, though vigilance is needed against upside risks from global commodity volatility and local supply disruptions. On monetary policy, he projected stable but elevated interest rates, alongside a steady exchange rate backed by strong external buffers. Mr. Arogo also addressed global uncertainties, notably the recent imposition of U.S. tariffs, cautioning that these could weigh on exports and investor sentiment. Nonetheless, he affirmed the underlying strength of the Philippine economy, supported by robust internal demand and fiscal momentum.

Three key points:

- PNB’s strategic focus is on digital banking, MSME support, and outreach to OFWs to drive inclusive financial services.

- The Philippine economy is forecast to grow by 6.2% in 2025, with key drivers being domestic consumption and public infrastructure investment.

- While U.S. tariffs pose a risk to trade performance, the Philippine economy remains fundamentally resilient due to solid internal growth dynamics.

(3) Q&A session

The audience actively participated in the Q&A session. From the series of questions enunciated, nine areas of interest were addressed as follows:

1. Policy Rate Fluctuations and BSP's Monetary Response

In response to a question about the sharp fluctuation in the Philippine policy rate from 2% to 6.5% over two years, Mr. Arogo explained that the 2% rate was a historical low set during the COVID-19 pandemic, when central banks worldwide cut rates to cushion economic activity. While the U.S. could bring its rates down to zero, the Philippines needed to maintain a positive interest rate differential to prevent currency depreciation. Post-pandemic, a series of global and domestic inflationary pressures—such as the European commodity shock, reopening supply chain bottlenecks, elevated shipping costs, and the impact of El Niño on rice prices—led to surging inflation. As a result, the Bangko Sentral ng Pilipinas (BSP) – the Philippine Central Bank - was compelled to act swiftly, raising the policy rate to 6.5%.

2. Missionary Branches and Collaboration with Local Stakeholders

Responding to a question about missionary branches, Ms. Ng clarified that while these branches take longer to break even compared to those in metropolitan areas, the outlook remains positive. PNB works closely not with the World Bank, but with local government units (LGUs), non-government organizations, and local stakeholders to meet the specific financial needs of underserved communities. These efforts include designing custom financial products and improving access to digital financial services, particularly in areas where physical and digital infrastructure remain limited. PNB remains a trusted partner in these “missionary” areas, helping them take crucial first steps toward financial inclusion.

3. Inflation Outlook and the Impact of U.S. Tariffs

Addressing a query on inflation projections amid recent U.S. tariffs, Mr. Arogo emphasized the role of base effects, especially in rice prices, which peaked from January to August 2024. Because of this, the year-on-year comparison favors a benign inflation outlook—justifying PNB Research's 2.5% full-year estimate. However, he cautioned that this is not fully forward-looking. Inflation risks could reemerge in late 2025 due to the uncertain impact of the U.S.-China tariff war. While some analysts expect a flood of cheap Chinese goods into Southeast Asia, helping to moderate inflation, others warn of supply chain disruptions and commodity price volatility. Overall, Mr. Arogo expects inflation to exceed BSP’s target by the first half of 2026.

4. Banking Sector Resilience Amid Economic Slowdown

Asked about the implications of a potential economic contraction, Mr Arogo noted that the first impact would likely be a rise in non-performing loans (NPLs). Nevertheless, he expressed confidence in the strength of the Philippine banking sector, which has learned from past crises, including the 1997 Asian Financial Crisis, the 2008 Global Financial Crisis, and the COVID-19 pandemic. While lending growth might slow due to weaker economic activity, strong regulatory oversight and prudent risk management provide the banking sector with resilience against current uncertainties, he further explained.

5. Role of Physical Branches in a Digitizing Landscape

When asked if PNB plans to reduce its physical branches in light of the digital shift, Ms. Ng reaffirmed the Bank’s dual strategy. Rather than phasing out physical infrastructure, PNB is transforming branches into service and advisory hubs. These reimagined branches will focus on personalized engagement, using analytics and digital tools to enhance the customer experience. Jennifer emphasized that physical branches, along with ATMs, will remain integral to PNB’s operations, especially in a country where in-person interaction is still vital for many customers.

6. Digital Financial Inclusion through QR Payments

Expanding on PNB’s digital initiatives, Ms. Ng described the bank’s efforts to promote QR Ph, a QR code-based payment system endorsed by the BSP and LGUs, adding that this initiative is particularly targeted at vendors and microentrepreneurs in local marketplaces. She said that PNB’s goal is not only to provide digital payment solutions but also to educate communities about digital finance and assure them of its safety. The Bank runs awareness campaigns to boost trust and adoption among Filipinos who are new to banking or unfamiliar with digital platforms, she pointed out.

7. Peso-Dollar Forecast and Exchange Rate Volatility

Mr. Arogo provided a cautious outlook on the peso-dollar exchange rate in light of global trade tensions and U.S. tariff policies. He remarked that while there is pressure for the peso to weaken—possibly reaching PHP 58–59 per USD—due to a shrinking export sector and trade deficit, the picture is complicated by U.S. goals to make its exports more affordable. Historical models can only explain about 85% of the exchange rate movement, leaving significant room for unpredictability, he added. Mr. Arogo advised against currency speculation under current conditions and recommended exchanging only when necessary.

8. Regional Trade Opportunities and Manufacturing Potential

On intra-regional trade, Mr. Arogo noted that Southeast Asia may see increased imports among member countries, partly redirecting trade flows away from the U.S. He acknowledged, however, that while regional integration is promising, the U.S. and China remain dominant forces. As a positive takeaway, Mr. Arogo advocated for building local manufacturing capacity. He cited the Philippine cacao and chocolate industry—particularly single-origin products from areas like Paquibato—as an example of how trade uncertainty can drive innovation and global market entry for niche Filipino exports.

9. Lending to Micro, Small, and Medium Enterprises (MSMEs)

Finally, in response to a question on MSME lending, Ms. Ng chose not to disclose the portfolio size but highlighted organizational changes within PNB that have enabled a more focused approach to this critical sector. She explained that previously, MSMEs were bundled with general lending, but a dedicated structure now supports more tailored services for this segment, recognizing the central role of MSMEs in employment and importance.

Copies of the presentation are available only to ABA members.

The video recording of the webinar can be viewed at the ABA YouTube.