Promoting Cooperation in Collaborating with Fintech Companies

(1) Context – Collaboration with fintech crucial

(1) Context – Collaboration with fintech crucial

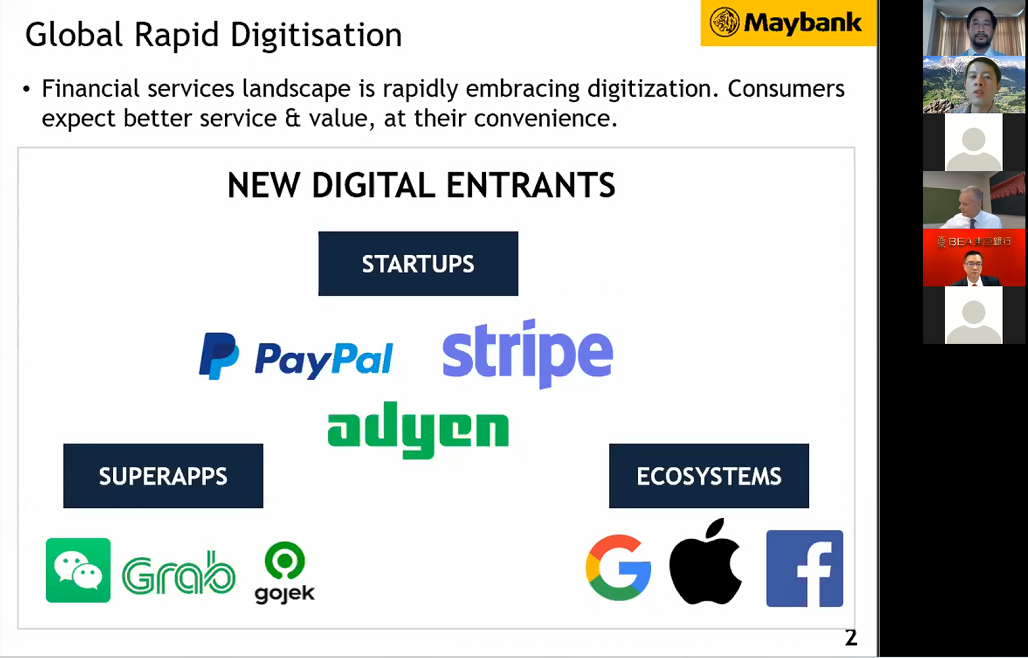

1.1 The business landscape is rapidly embracing digitisation and consumers expect better service and value at their convenience. The shift to Digital has also accelerated immensely due to the global advent of COVID.

1.2 New digital entrants are entering the financial services industry with new models, products, and approaches. These superapps, ecosystem players & fintech firms threaten to disintermediate banks, reducing the visibility banks have over their customers.

1.3 On the other hand, fintech players face a different set of problems – Lack of customer trust, absence of scale & need to build ground up, and meeting regulatory requirements.

1.4 This new landscape has necessitated partnerships between banks and fintech players to remain at the forefront of customers’ minds, through combining partnership-led experiences with internally built capabilities.

(2) Malaysia: Government policy & regulations that promote collaboration

Government policies & regulations can serve as a barrier or incentive for collaboration between banks & fintech. It is the role of regulators to ensure that the financial system remains safe & stable, while promoting a conducive environment for innovation & technological advancement.

In Malaysia, active dialogue with industry players has served as an important lever in promoting collaboration. Bank Negara Malaysia has committed to play a facilitative role to enable innovation to flourish, and has committed to (1) Building interoperable structures for open & fair access to players; (2) Dynamic approach to supervision & regulation to allow room for experimentation; (3) Strengthening platforms for collaboration.

2.1 Current policies/regulations promoting collaboration between Banks & Fintech

2.1.1 ‘DuitNow’ in the Real-time Payments Platform (RPP)

The platform serves as an interoperable structure between banks & fintech players (mainly e-wallets). The service enables instant credit transfers between participating players, with a national addressing database that links a ‘DuitNow ID’ (mobile or national identity numbers) to user-specified recipient accounts.

The service initially facilitated fund transfers between bank accounts, but is moving to incorporate fintech players, including GrabPay, Touch N’ Go Digital, BigPay, Fave, and other non-bank digital players.

In addition, the next phase includes a framework for interoperable QR payments. Participating players, both fintech & banks alike, will be able to scan a national QR code and make payments to all participating banks & ewallets.

This serves to unify all cashless payments and promotes the collaboration between Banks & Fintech.

2.1.2 Open API policy document – ’Publishing Open Data using Open API’ Bank Negara Malaysia (BNM) issued a policy document to standardize development & publication of open APIs. This promotes collaboration between banks & fintech, through the improvement of access to data from banks & insurers. The API specifications target product information on 3 specific areas:

2.1.2.1 Credit Card

2.1.2.2 SME Financing

2.1.2.3 Motor Insurance/Takaful

2.2 Potential Upcoming Regulations

The global banking landscape is evolving. The recent pandemic has resulted in delays in several regulatory frameworks, but it’s expected that these regulations will be introduced in some form, introducing new dynamics to the fintech & banking relationship.

2.2.1 Open Banking PSD2

2.2.2 Interoperable Payments Frameworks

2.2.3 Digital Bank Licenses

2.2.4 National ID & eKYC frameworks

2.2.5 Central Bank Digital Currencies

2.2.6 Banking as a Service (BaaS)

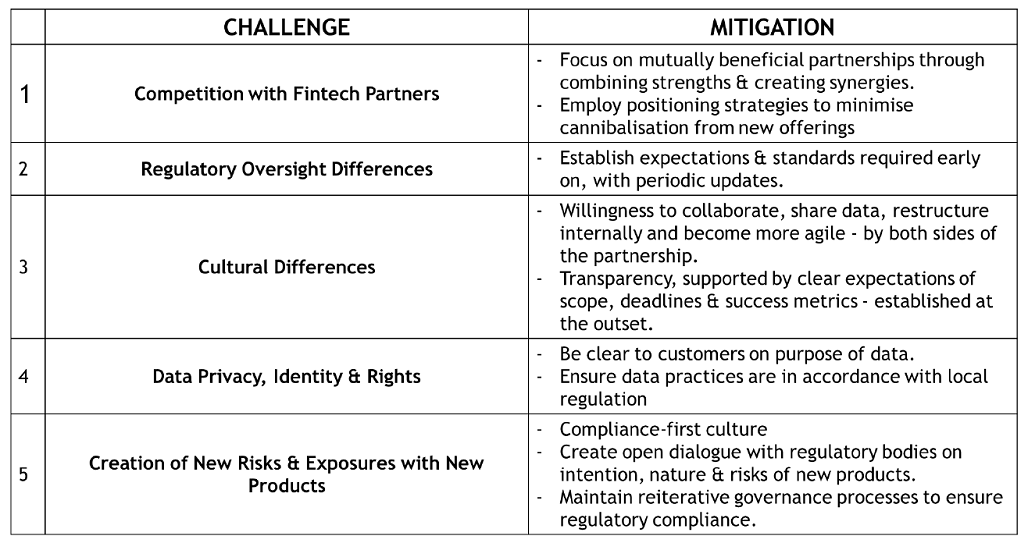

(3) Overcoming fintech collaboration challenges: Collaborations with fintech companies can be difficult, as they can involve companies with different backgrounds, expectations and capabilities.

(4) Closing: fintech – the age of partnerships and collaboration

The growing demands of customers for rapid innovation has necessitated partnerships & alliances between banks & fintech companies. While incumbent banks face innovation challenges specific to their traditional business models & legacy systems, fintech companies face their own set of difficulties – such as winning the trust of customers, meeting regulatory requirements, and unlocking scalability.

To compensate for these shortcomings, banks & fintech companies are increasingly entering strategic alliances & partnerships. However, disciplined execution is crucial to ensure that partnerships are productive and achieve target outcomes. The key to mutually beneficial, fruitful partnerships is in the ability to identify opportunities to unlock value, the willingness to adapt & collaborate, and the discipline to maintain strict compliance & regulatory standards.

Prepared for the Asian Bankers Association by:

Mr. Lionel Ho Tse-Kuang

Mr. Lionel Ho Tse-Kuang

Head, Digital Strategy

GS-Group Digital

Malayan Banking Berhad