From Risk to Resilience: The Need for Asian Banks to Comprehensively Address Physical Climate Risks

I. Introduction

I. Introduction

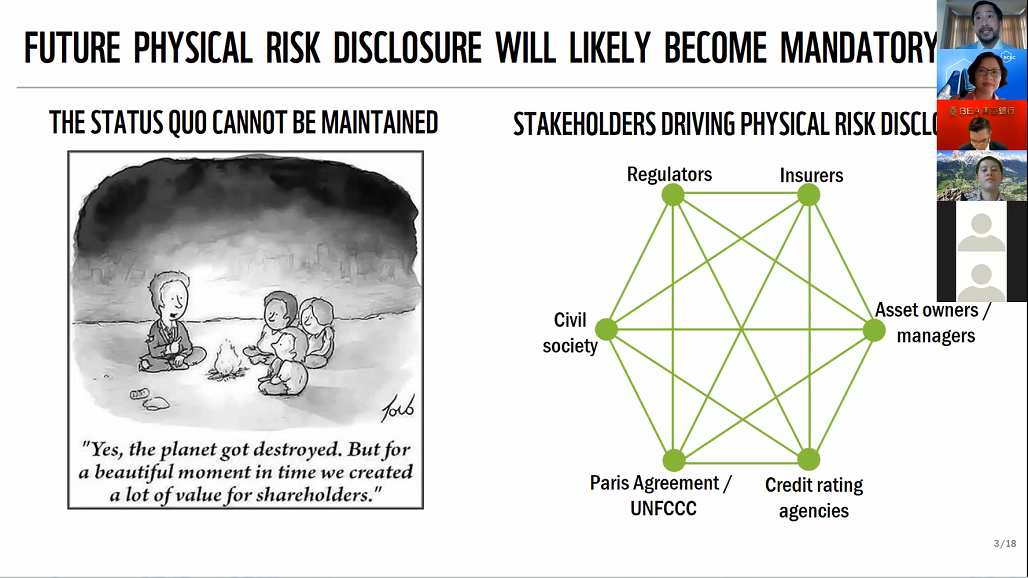

(1) To date most attention given to the nexus between climate change and private finance has focused on economic decarbonisation. For instance, climate change mitigation and transition risk take centre stage in discussions on the disclosure of climate-related risks and opportunities. While this attention is undoubtedly valid, it misses the vital role financial institutions have in supporting adaptation efforts as well as the dangers which physical risk pose to the financial sector. This paper seeks to start the process of addressing this by 1) outlining what and why physical risks should be a concern, 2) how physical risks can affect financial institutions, and 3) and how physical risk can be addressed.

II. What are physical risks?

(2) Physical risks refer to the likelihood of nature-related hazards occurring and their impacts when they occur. Understanding physical risks requires knowledge on 1) natural hazards and their potential occurrence, 2) exposure of business activity and assets to physical hazards, 3) sensitivity of business activities or assets and the wider context to nature-related hazards, and 4) the adaptive capacity of stakeholders to physical risksi.

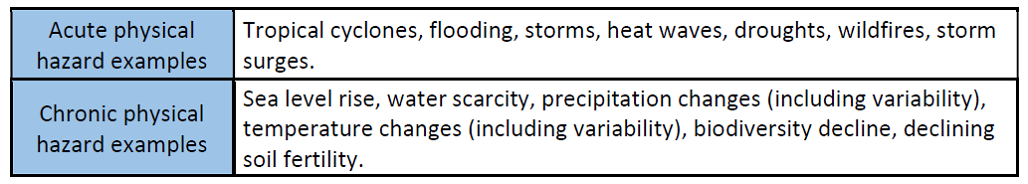

(3) The TCFD Framework splits physical risks into acute hazards (event driven) and chronic hazards (driven by long-term shifts). An inevitable focus is on climate-related physical risks. However, all physical hazards should be of concern as 1) physical hazards often have multiple causes (e.g. climate change and environment degradation), 2) exposure exists regardless of underlying causes, 3) impact does not depend on underlying causes.

III. Physical risks will increase for the foreseeable future

(4) Physical risks will likely become unmanageable if global green-house gas emissions do not reach net-zero by 2050. This is why 197 countries under the United Nations Framework Convention on Climate Change and its Paris Agreement aim to restrict global average temperature rise to well below 2°C above pre-industrial levels and to pursue efforts to limit the temperature increase to 1.5 °C above pre-industrial levels, recognizing that this would significantly reduce physical risks.

(5) However, physical risks are already on the rise and will continue to do so as ecosystem degradation and climate change continue to worsen. Even if the goals of the Paris Agreement are achieved physical risks will not stop. Efforts to limit climate change are to prevent catastrophic levels of physical risks, not to stop them from occurring.

(6) Unfortunately, current mitigation efforts are insufficient with national pledges resulting in 3.1-3.7°C of global average temperature rise. Consequently, Banks should only expect physical risks to increase. Precisely how much is difficult to project due to ‘global tipping points’ and interactions associated with socioeconomic systems and the natural environment.

IV. Transmission channels of physical risk

(7) Physical risks have characteristics which make them especially difficult to manage:

- Changes in their magnitude and frequency of physical risks will be non-linear and Difficult to predict over the long-term.

- Surpassing ecosystem ‘tipping points’ will lead to rapid ecosystem change, yet understanding when these will be surpassed is difficult to know.

- As climate change increases historical climate and weather data will be less useful for predicting the future

- Physical risks are covariate with both localised and systemic impacts.

(8) Corporates exposure to physical risk can be thought of as first order impacts and second order impacts both of which affect corporate financial performance, capital expenditure, and operating expenditureii. First order impacts, refer to the direct implications of physical hazards on operations and assets, supply chains (including logistic issues), and markets. Activities more reliant upon natural capital as production inputs, within supply processes, or are located in geographically vulnerable locations (including upstream and downstream connections) are more exposed to physical risks.

The impact will also partly be determined by the existence and adequacy of risk management plans, and the implications of planned responses on income and cash flow statements and their balance sheetiii. Second order impacts, refer to the impact of physical hazards on environmental, social, economic, and governance systems. They are difficult to predict and manage through traditional risk management approaches as second order impacts are highly context specific and will differ even at localised levels.

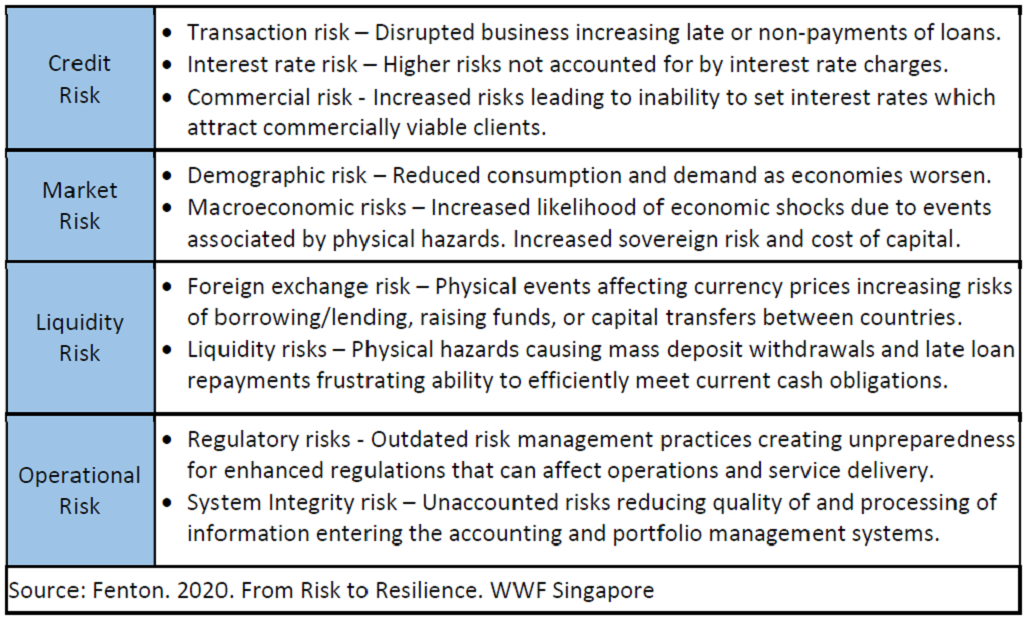

(9) As risk aggregators, banks directly inherit the physical risks to which clients are exposed. Physical risk can also have a direct negative impact on a bank’s operations (see table below). As a transverse risk, physical risk manifests itself through existing risk channels, rather being its own risk factor.

V. Identifying and projecting physical risk impacts?

(10) Much more attention will need to be given by banks to physical risk stress testing which can be applied at transaction, portfolio, organisation or market level. Physical risk scenario stress testing can be used: 1) internally with the objective to assess existing portfolios and operations to credit, market, liquidity, and operational risks; 2) to assess implications of physical risks on sectors and markets to help form lending policies; and 3) to assess potential and current clients.

(11) Most assessments to date have first assessed direct and indirect impacts of physical hazards on company financials and then integrate these into financial models to quantify financial risks using tradition risk classificationsiv. Scenario stress testing, helps decision making by providing insight, it does not give definitive answers, results will inevitably be subjectively interpreted. The uncertainties and complexities involved mean it is more art than science. Multiple scenarios spanning different potential temperature increases will be required due to the uncertainty regarding efforts to reduce GHG emissions. Physical risk scenario analysis generally has four general stages:

1) Identify objectives and exposures, 2) Designing physical risk scenarios, 3) assessing impacts of physical risks, and 4) Managing physical risks and communicating results

(12) There are various tools and service providers which can be used to assess acute and chronic physical risks. Suitability of tools will depend on circumstance. The follow factors help individual banks choose the most relevant tool or service provider for them:

1) historical data (although as climate change intensifies the past increasingly becomes an unreliable predictor of the future), 2) future time periods covered, 3) future scenarios provided, 4) user inputs and outputs, 5) spatial resolutions and coverage, 6) whether acute and/or chronic physical risks are covered and 7) cost. UNEP-FIs TCFD Banking Pilot Project Phase II Report provides an extensive summary of tools and service providers.

VI. Physical risks are reduced through adaptation

(13) Businesses that are better able to manage physical risk will likely gain competitive advantages of their peers and will be less risky clients for banks. Many activities can be classified as adaptation – though not all would be classified as such by banks. The recent EU ‘Taxonomy’ states that an action can be considered as ‘adaptation’ when:

- Material physical risk reduction is maximised according to best available science.

- Vulnerability of others is not increased.

- Measurable adaptation-related outcomes exist.

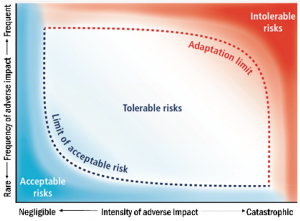

(14) Adaptation limits exist, meaning it is not always practically or theoretically possiblei. Often residual ‘loss and damage’ will exist. Many constraints restrict adaptation (e.g. physical, biological, economic, and financial limits). Limits are not static. Sometimes limits can be overcome via ‘transformational’ actions fundamentally altering the activity (e.g. naturebased solutions which protect and repair ecosystems services). Limits should be established on a case by case basis and should influence adaptation strategy.

(14) Adaptation limits exist, meaning it is not always practically or theoretically possiblei. Often residual ‘loss and damage’ will exist. Many constraints restrict adaptation (e.g. physical, biological, economic, and financial limits). Limits are not static. Sometimes limits can be overcome via ‘transformational’ actions fundamentally altering the activity (e.g. naturebased solutions which protect and repair ecosystems services). Limits should be established on a case by case basis and should influence adaptation strategy.

(15) Adaptation efforts can be placed on a private to public continuum. Most will be private, addressing location and context-specific physical risks on an economic activity for private benefits. The most significant will be public, reducing physical risks on natural or built environments within which economic activities takes place for public benefit. Public investment is vital due to the covariate nature of physical risks and thus resolving them is typically a ‘public good’.

(16) Vastly insufficient levels of public adaptation planning and expenditure exist. Many countries have no National Adaptation Plan. In 2016 public adaptation finance was estimated to stand at US$23 billion, in contrast annual adaptation costs are estimated to range between US$140-US$300 billion by 2030 and from US$280-US$500 billion by 2050v. With public finances already constrained, private and public finance has to leveraged to implemented required adaptations for the long term benefit for all.

VII. Determinants of vulnerability and resilience

(17) Efforts to understand physical risks must also focus on understanding sensitivity and resilience as well as only exposure. The recent UNEP-FI TCFD Banking Pilot Project Phase II Report highlighted eight potential indicators for assessing business sensitivity to physical risks: 1) reliance on natural resources, 2) reliance on secure energy supplies, 3) reliance on climate sensitive supplies, 4) reliance on secure transport routes, 5) reliance on efficient operation of assets and processes, 6) climate sensitivity of market demand, 7) potential for environmental and social impact, and 8) reliance on labour health and productivity vi.

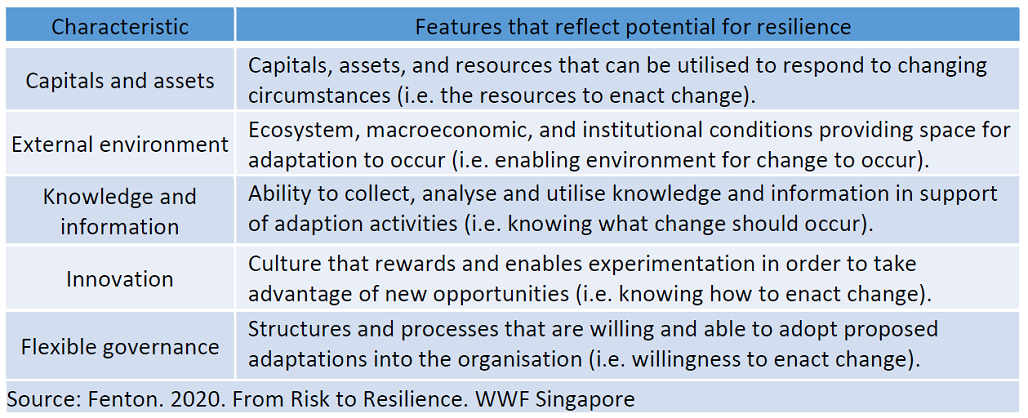

(18) The aim of adaptation is resilience – the capacity to withstand and rebound from the consequences of physical hazard events and to adapt to future anticipated physical risks. Resilience is theoretically inversely correlated with credit risk and as a result screening and assessing clients for resilience to physical risks should be a priority in risk assessment.

(19) Currently, more attention has been given to producing vulnerability indices instead of resilience indices. However, both should be of equal concern. The TCFD framework would support the development of a resilience index as the processes and structures ultimately required for compliance against the framework provide the necessary basis to manage physical risks.

The presentation file can be downloaded HERE.

Prepared for the Asian Bankers Association by:

Dr. Adrian Fenton

Dr. Adrian Fenton

Vice President, Asia Sustainable Finance

World Wide Fund for Nature (WWF) Singapore

i Source: IPCC. 2014.: Impacts, Adaptation, and Vulnerability. Part A: Global and Sectoral Aspects.

ii Source: EBRD. 2020. Advancing TCFD guidance on physical climate risks and opportunities.

iii Source: CDSB. 2017. Implementing the Recommendations of the TCFD.

iv Source: NGFS. 2020. Overview of Environmental Risk Analysis by Financial Institutions.

v Source: UNEP. 2016. The Adaptation Finance Gap Report.

vi Source: UNEP. 2020. Charting a New Climate: State-of-the-art tools and data for banks to assess credit risks and opportunities from physical climate change impacts.