Banking Sector from a Perspective of Climate Change & Sustainable Finance: Latest Trends in Türkiye (1)

I. Introduction

Climate change is a major issue of our era in the international sphere with various impacts and it is a well-established fact that it leads to new definitions with respect to social-economic development and geopolitical contexts.

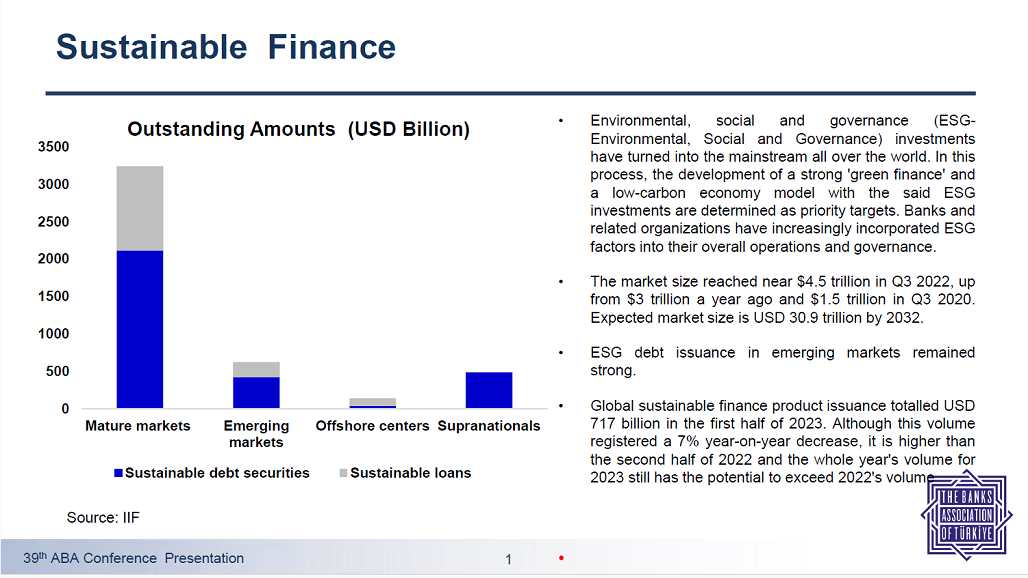

Sustainable Finance is the process of considering environmental, social and governance (ESG) considerations when making investment decisions in the financial sector, leading to longer-term investments in sustainable economic activities and projects. It came to be a strong global movement managed by regulators, corporate investors and asset managers. However, sustainability is a complex and developing issue.

Environmental, social and governance (ESG) investments are now mainstream all around the world and the development of a strong “green finance” and low-carbon economic model through these investments is a major objective in an effort to reduce the negative impacts of greenhouse gas emissions and pollution on the environment.

II. Banking Sector and the Activities of the Banks Association of Türkiye in terms of the Developments in Türkiye

As the Turkish Banking Sector plays a special role in the world and in Türkiye in the correct management of processes related to climate change, in addition to its function as an intermediary in the collection and use of financial resources, new steps are constantly taken in the areas related with the responsibility of the banks. Banks perform environmental and social risk assessments and monitoring processes in line with national and international regulations as well as global standards. Raising awareness on proper management of climate change risks encourages international collaborations in the country. In this sense, a new era started in Türkiye with the approval of Paris Climate Agreement.

Public institutions make regular efforts to create the regulative framework to support green economy, calculate YVO in accordance with international practices and quantify Environmental, Social, Governance (ESG) and climate risks.

The Turkish banking industry closely monitors international regulating standards and operates with an approach of integrated environmental, social and corporate governance. Banks perform environmental and social risk assessments and monitoring processes in line with national and international regulations as well as global standards.

“Green Deal Action Plan”(2) issued by the Ministry of Trade on July 16, 2021 created a roadmap to ensure compliance with possible changes triggered by AYM and set objectives in “Border Carbon Adjustments”, “Green Finance” and “Sustainable Agriculture”.

In July 2021, a “Green Deal Research Group” was created by the representatives from Ministry of Trade, Ministry of Environment, Urban Development and Climate Change, Ministry of Industry and Technology and Ministry of Energy and Natural Resources. The Ministry also created the “Sustainable Consumption and Manufacturing Action Plan Expertise Research Group”, “Zero Pollution Action Expertise Research Group”. Furthermore, TCMB supports research projects and international collaborations against climate change. Finally, Taxonomy Technical Expertise Group meetings are held by the Ministry of Environment, Urban Development and Climate Change.

Global Compact Türkiye Sustainable Finance Declaration issued by Türkiye’s leading banks in 2017 was updated in 2021 based on the latest developments. The latest updates increased the extent and impact of the Declaration by including the “environmental and social impacts to the credit assessment processes” and adding “innovative sustainable finance principles”. The Declaration states that the signatory banks will lead an inclusive sustainable finance approach in loan processes and sustainable banking products.

“Sustainable Banking Strategy Plan”(3) issued by BDDK in December 2021 and “Green Bonds, Sustainable Bonds, Green Lease Certificates, Sustainable Lease Certificates Guidelines”(4) issued by SPK in December 2022 will lead the way in creating a financial system focused on climate policies.

The efforts to create the necessary infrastructure in Türkiye based on these developments are in progress. In this sense, Article 88 of Turkish Commercial Law 6102 was amended as follows with the Official Gazette 31856 dated June 4, 2022 and KGK was authorized to define Turkish Sustainable Reporting Standards: “Public Oversight, Accounting and Audit Standards Institution (KGK) is authorized to define and issue Turkish Sustainability Reporting Standards in compliance with international standards to ensure consistency in implementation and international acceptance of sustainability reports. Institutions and committees established by law to regulate and audit certain areas are authorized to make detailed regulations in their areas of expertise provided that they comply with Turkish Sustainability Reporting Standards.”

Following the issue of Turkish Sustainable Reporting Standards with the public announcement dated 16/06/2022 by KGK, the objectives include ensuring consistency in implementation, ensuring comparability, ensuring international acceptance of the reports and aligning sustainability reporting and financial reporting.

The announcement dated June 2, 2023 by KGK reads as follows.

“IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information (draft) and IFRS S2 Climate-related Disclosure (draft) standards issued by International Sustainability Standards Board (ISSB) were translated and Assurance Audit Standards (GDS 3000 Independent Audit for Historical Financial Data or Assurance Audits Other Than Limited Independent Audits and GDS 3410 Assurance Audits on Greenhouse Gas Declarations) and application guidelines for sustainable assurance audits (GDS 3000 Non-compulsory Guidelines for Sustainability and Other Extended External Reporting Assurance Audits) issued by International Auditing and Assurance Standards Board (IAASB) were adapted”(5) (KGK, 2023, p.1).

On the other hand, International Organization of Securities Commissions (IOSCO) has reviewed the Sustainability Disclosure Standards issued by the International Sustainability Standards Board (ISSB) on June 26, 2023 and approved them on July 25, 2023.

Türkiye has issued its UNFCCC National Convention İntention Declaration in 2015. The objective is to reduce the emissions by minimum 21% until 2030 based on current policies. The objectives were updated at the COP27 Conference in 2022. In this sense, the reduction objective for 2030 was increased from 21% to 41% and the peak date was defined as 2038.

The Climate Law is being prepared by the Ministry of Environment, Urban Development and Climate Change Climate Change Directorate. BDDK issued the impact analysis titled “Possible Impacts of European Union Carbon Border Adjustment Mechanism on the Credit Portfolio of Turkish Banking Sector” in December 2022(6).

The report reads: “General trend of increase in the carbon prices established by EU Emission Trade System and implemented through SKDM reveals that carbon taxes corresponding to the emissions created by manufacturing can increase significantly. These data reveal that SKDM can create risks for the industry (especially steel, aluminum and cement industries) and the financial system, including the limited application period which will start in 2026. In this sense, understanding and monitoring the risks from a cautious mid-term perspective and estimating the possible impacts to take the necessary measures is of critical importance for the health of financial institutions and the financial system as a whole.” (Mesutoğlu, B, BRSA, 2022, s.2-3)

The 2022-2024 Medium-term Plan (OVP) which was issued in the Official Gazette dated September 5, 2021 lists the “Green Transformation” among the macroeconomic objectives and stresses the importance of transition to green economy. The OVP states that the Ministry of Trade will issue the Action Plan to specify the actions required to adapt to global developments and attract investment, especially from EU shaped by the Green Deal.

The Action Plan in the OVP includes a section titled green finance and includes the following actions;

- Preparation of regulations to define the sustainability of investments based on the taxonomy regulations of the EU and international institutions,

- Defining a roadmap to improve sustainable banking,

- Defining initiatives to improve access to international finance for green transformation in Türkiye,

- Developing Green Bonds and Green Sukuk Guidelines which are closely related with the banking sector.

Finally, OVP (2024-2026) issued in the Official Gazette 32301 dated September 6,

2023 lists 31 policies and measures regarding the “8th Green Transformation”(7).

III. Sectoral Sustainability Efforts

III. a. Sustainability Efforts at the Banks Association of Türkiye

The Association’s activities on sustainability are as follows.

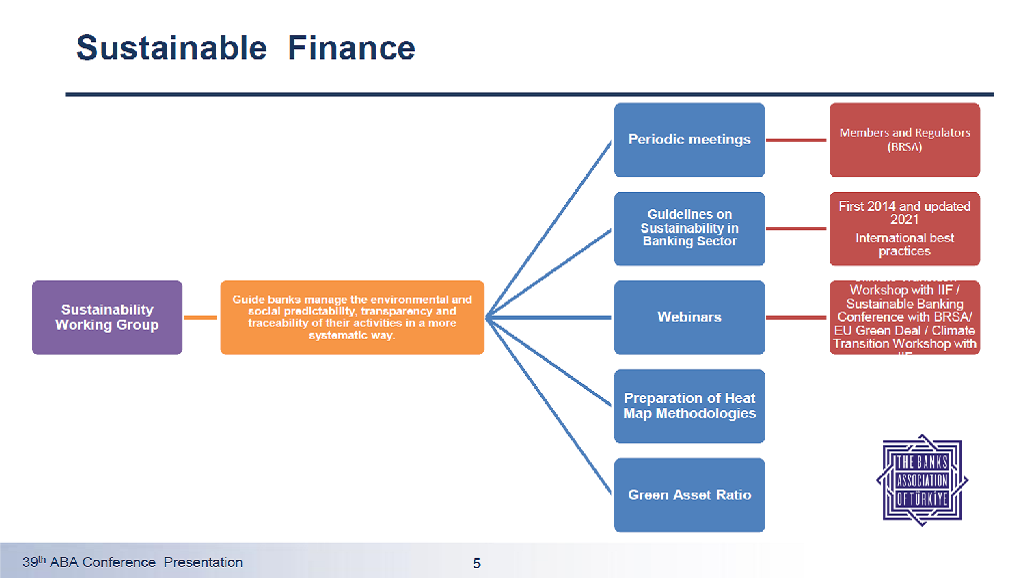

- Sustainability Working Group: The Banks Association of Türkiye (BAT) Executive Board created the Sustainability Working Group in 2009 to help the banks systematically manage the environmental and social aspects of their activities in terms of transparency and tracking.

“Sustainability Guidelines for the Banking Sector” drafted by BAT Sustainability Working Group in 2014 regarding the environmental and social aspects of development was updated in March 2021 and shared by the members, institutions and the public.

- “Sustainability Guidelines for the Banking Sector” drafted by the Working Group in 2014 regarding the environmental and social aspects of development was updated in March 2021 and shared by the members, institutions and the public.

- Recommendations in Task Force on Climate-related Financial Disclosures (TCFD) and national and international initiatives on climate change (e.g. UNEP-FI) are monitored and assessed.

- Efforts and contributions are made to increase public awareness on climate change.

- Guidelines for the Establishment of Green Asset Ratio: Statistical efforts are made to objectively measure and monitor sustainable finance efforts. With the increasing impact of global warming and climate change, financial auditors and banking and finance institutions all around the world have focused on measuring, analyzing and managing climate-related financial risks. In this sense, a decision was made in Türkiye to create a YVO guide for the banking industry based on international regulations and practices. Green Assets Ratio Working Group(8)(12) which also includes representatives from BDDK created the “Guidelines to Develop Green Assets Ratio” to develop methods to calculate YVO.

- Climate Risks Sub Working Group(9) was established by the Sustainability Research Group to develop heat map methodologies.

- Monthly meetings are held with the public authorities on “Practices of Members on Sustainability Best Practices”.

- Basic and advanced training modules on sustainability were developed.

- Contributions are made to national sustainability platforms.

- European Green Deal is a model that was and continues to be developed in an effort to effectively respond to the global transformation and resulting changes. This new economic model and related efforts are closely monitored.

- The Association and the members also support the Expertise Research Groups created by the relevant ministries regarding the “Green Deal Action Plan”. Members also attend the meetings of Taxonomy Technical Expertise Group established by the Ministry of Environment and Urban Development.

- Webinars, Sustainable Banking Workshop and Türkiye Transition Finance Workshop were organized in collaboration with IIF on “Possible Impacts of Climate Change Risks and Opportunities on the Banking Industry” and “EU Green Deal”.

- Banking sector and real sector collaborated with ISO, TİM and other institutions. We also attend activities organized by universities and NGOs.

- The Association created a web page with national and international efforts on “Sustainability” and the page shares recommendations, sustainability efforts by the members of Sustainability Research Group and Participation Banks Association of Türkiye as well as major international reports in Turkish and English.

- The Association also manages the Sustainability Consultancy Project based in international best practices on sustainability. The Association also manages the certification application processes (ISO14001 etc.) and has drafted and shared Sustainability in the Banking Sector: Sectoral Outlook and “Banks Association of Türkiye Sustainability Report” in 2022 (10).

- Finally, “Banks Association of Türkiye Greenhouse Gas Emissions Calculation Report” was drafted and shared with the public through the web site.

- Furthermore, BAT Executive Board has shared recommendations on sustainability with the members and the public

III. b. Certain Recent Efforts by the Banks on Sustainability

Banks have direct and indirect environmental and social impacts through their activities as well as the loans they grant and therefore activities of our members are summarized below. Best practices by the members of sustainability are available on the Association’s web site (www.tbb.org.tr) under “sustainability” page.

- Long-term thematic loans are offered to support transition to a low-carbon economy.

- Efforts are in progress to build an environmental and social impact management system.

- The Climate Change Action Plan has been issued to support Türkiye’s transition to a low-carbon economy and struggle with climate change.

- Banks purchase carbon credits to significantly reduce absolute carbon emissions and eliminate the remaining.

- Investments in wind, geothermal, solar and biogas/biomass resources are supported in the segment of renewables.

- The objectives of Resource Efficiency Financing Projects include more efficient use of natural resources, less waste generation, reusing of waste and creating less carbon emissions.

- Partnerships are built with national and international stakeholders to raise awareness on climate change, share information and ensure coherence of objectives. In this sense, certain members of the Association are also engaged in United Nations Global Agreement, United Nations Environmental Program Finance Initiative, Sustainable Development Goals and Global Reporting Initiative.

- Some members issue annual reports on their activities under Carbon Disclosure Project (CDP) Climate Change Program.

- Banks offer products and services with environmental and social impacts to raise awareness. Financing clients for sustainable energy, sustainable agriculture, more efficient use of natural resources, waste management, resource efficiency and recycling,

- Finance packages to support SMEs and entrepreneurs and employ women and young people,

- Financing energy and resource efficiency, manufacturing processes and waste management in steel, cement, textile, aluminum, automotive and chemicals industries.

- Capital-equivalent Sustainable Bonds, Transition to Low-carbon Economy Bonds and other bonds related with sustainability as well as Sustainable Lease Certificates are issued in global markets.

- Projects for gender equality and employment of women have been supported.

- The Green Deal Action Plan drafted by the European Commission is estimated to have a strong impact on Türkiye due to Türkiye’s strong relations with the EU. In this sense, works are in progress on the potential impact of regulatory changes on Turkish industries. We intend to offer direct and indirect support for our members during the transition process.

- Our members are willing to do their share of work regarding the forest fires and mucilage in Türkiye, which are the results of climate change.

- Some members are also members of United Nations Net-zero Banking Association established in 2021 based on the objectives of the Paris Agreement.

- Some banks offer green deposit account products(11) for the clients.

IV. Conclusion & Assessments

Climate change is a major issue on a national and international level. In addition to its impacts on our daily lives, new definitions are created regarding social-economic and geopolitical issues, sometimes referred to as geo-economics. All national economies create and implement sustainable economy policies based on this environment.

In this process, banks perform environmental and social risk assessments and monitoring processes in line with national and international regulations as well as global standards. Banks have been taking major steps to make climate change and the environment a major part of their activities and strategies.

As the Turkish Banking Sector plays a special role in the world and in Türkiye in the correct management of processes related to climate change, in addition to its function as an intermediary in the collection and use of financial resources, new steps are constantly taken in the areas related with the responsibility of the banks. Raising awareness on proper management of climate change risks encourages international collaborations in the country. They also collaborate with public institutions to create the regulative framework in an effort to expand the green economy.

Another major issue is data collection and data quality. An extensive data set is required to measure the impact of climate risks on banking. We will have to use global data until a reliable data set is created in the country. For example, to what extent will the bank customers’ preferences affected by the green transformation? The methods of reflecting the digitalization of climate risks to the loan portfolios and managing these processes should be developed.

On the other hand, a major contribution of the banks to these policies will be financing the green transformation of the economy. Manufacturing, heavy manufacturing and agriculture industries may not meet harsh environmental requirements immediately, but they have to improve their performances consistently.

The Presentation File (PDF format) can be downloaded HERE.

The Video recording of Pelin Ataman Erdönmez,Director at The Banks Association of Türkiye, can be viewed in the ABA YouTube.

Prepared for the Asian Bankers Association by:

Pelin Ataman Erdönmez

Director

The Banks Association of Türkiye

Footnotes:

(1) For furher details concerning the Latest Trends in the World, EU and Türkiye are available at https://www.tbb.org.tr/tr/bankacilik/arastirma-ve-yayinlar/surdurulebilirlik/4507.

(2) https://ticaret.gov.tr/data/60f1200013b876eb28421b23/MUTABAKAT%20YE%C5%9E%C4%B0Lpdf.

(3) https://www.bddk.org.tr/Duyuru/EkGetir/902?ekId=810.

(4) https://spk.gov.tr/data/6231ce881b41c612808a3a1c/b2d06c64099c9e7e8877743afc7d2484.pdf

(5) Detailed information is available at www.kgk.gov.tr.

(6) https://www.bddk.org.tr/KurumHakkinda/EkGetir/18?ekId=114.

(7) OVP (2024-2026) Term

(8) Green Transformation lists these policies and measures. https://www.resmigazete.gov.tr/eskiler/2023/09/20230906M1-1.pdf. Türkiye İş Bankası A.Ş., Türkiye Kalkınma ve Yatırım Bankası A.Ş., Türkiye Sınai Kalkınma Bankası A.Ş., Türkiye Vakıflar Bankası T.A.O., Yapı ve Kredi Bankası A.Ş.).

(9) Climate Risks Sub Research Committee has 15 members and BDDK representatives: Akbank T.A.Ş., Denizbank A.Ş., QNB Finansbank A.Ş., HSBC Bank A.Ş., ING Bank A.Ş., Şekerbank T.A.Ş., Türkiye Halk Bankası A.Ş., Türkiye İş Bankası A.Ş., Türkiye Kalkınma ve Yatırım Bankası A.Ş., Türkiye Vakıflar Bankası T.A.O., Türkiye Cumhuriyeti Ziraat Bankası A.Ş., Türk Eximbank, Türkiye Garanti Bankası A.Ş., Türkiye Sınai Kalkınma Bankası A.Ş., Yapı ve Kredi Bankası A.Ş.

(10) The reports are available at BAT web site (https://www.tbb.org.tr/tr/bankacilik/arastirma-veyayinlar/surdurulebilirlik/4507).

(11) Green deposit (Sustainable/ESG/Green Time deposit) is defined as using a certain amount of bank deposits to finance green projects.