The role of the risk manager has always been to understand and manage threats to a given business. In theory, this involves a very broad mandate to capture all possible risks, both current and future.

The role of the risk manager has always been to understand and manage threats to a given business. In theory, this involves a very broad mandate to capture all possible risks, both current and future.

In practice, however, some risk managers are assigned to narrower, siloed roles, with tasks that can seem somewhat disconnected from key business objectives. Amidst a changing risk landscape and increasing availability of technological tools that enable risk managers to do more, there is both a need and an opportunity to move toward that broader risk manager role.

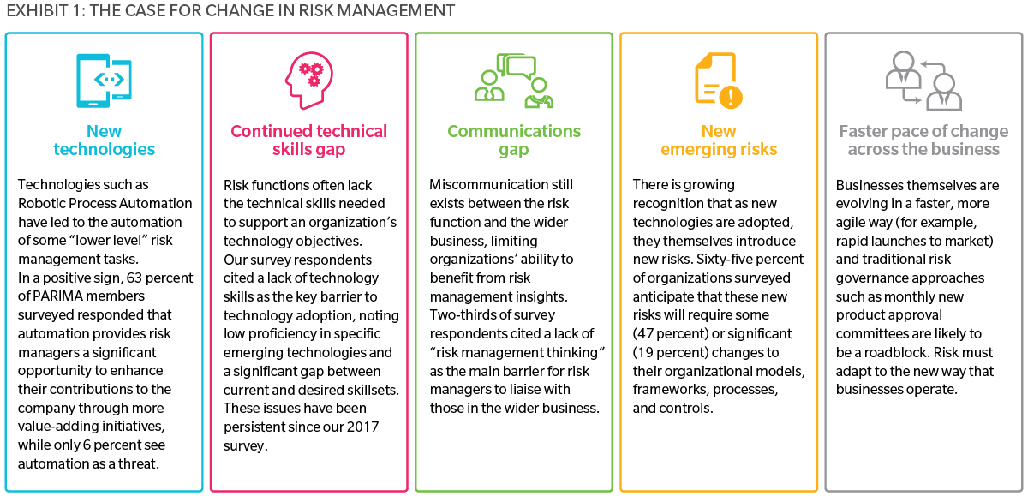

This need for change – not only in the risk manager’s role, but also in the broader approach to organizational risk management and technological change – is driven by:

- New technologies

- Continued technical skills gap

- Communications gap

- New emerging risks

- Faster pace of change across the business

In this cross-industry report, Marsh & McLennan Insights and the Pan-Asia Risk and Insurance Management Association (PARIMA) examine the degree to which a risk manager’s role must evolve in order to effectively incorporate emerging technologies into the risk function.

The report also discusses how the technological shift will both enable and require the risk manager to contribute to more value-adding initiatives in a business advisory role, in order to remain relevant.

This paper comes on the back of Insights’ and PARIMA’s successful joint publication in 2017, which discussed how the risk management profession was facing an increasingly complex and shifting business landscape, while also being constrained in terms of resources. This previous report identified emerging technologies and a more digitalized risk function as a promising solution, allowing risk managers to do more with less.

Developing the Risk Function of the Future

Developing the Risk Function of the Future

Related themes: Emerging Risks, Transformative Technologies, Workforce for the Future

Leave a Reply