Fintelekt Advisory Services and the Asian Bankers Association jointly organised a virtual workshop on Effectively Managing the Compliance Function on May 7, 2024.

Fintelekt Advisory Services and the Asian Bankers Association jointly organised a virtual workshop on Effectively Managing the Compliance Function on May 7, 2024.

The resource person for the workshop was Gail Wessels, Compliance, Risk and Corporate Governance Specialist, Regulatory and Financial Crime Compliance Trainer and a lawyer based in Spain. Gail is an empaneled trainer with Fintelekt. Arpita Bedekar, Director, Strategy and Planning, Fintelekt facilitated the workshop.

The virtual workshop was very well attended, with participants from more than 17 countries and 27 different institutions, including banks, insurance companies, mutual funds, money remittance companies, regulatory bodies, and technology companies. 12 participants took advantage of the free registration for ABA members.

The workshop focused on the multi-faceted role of the compliance function and what is required for its success. Gail started by defining the scope of the compliance function especially within the internal corporate context and external factors. She highlighted that the overlap with areas such as governance, risk and sustainability and the positioning of compliance within the organisation is fundamental to its success.

The workshop focused on the multi-faceted role of the compliance function and what is required for its success. Gail started by defining the scope of the compliance function especially within the internal corporate context and external factors. She highlighted that the overlap with areas such as governance, risk and sustainability and the positioning of compliance within the organisation is fundamental to its success.

She also discussed the positioning of the compliance function within the organisation, its authority and independence which consists of its structure, seniority and stature, autonomy and outsourced compliance functions. She stressed that the Board of Directors play a very important role in overseeing compliance and designing robust mechanisms to ensure that the corporation adheres to regulations.

According to Gail, the purpose and value of compliance is in moving away from a tick-box approach to a a compliance strategy that anticipates future trends across products, services and geographies. She highlighted the key elements of an effective compliance programme and examined the role of each of the elements

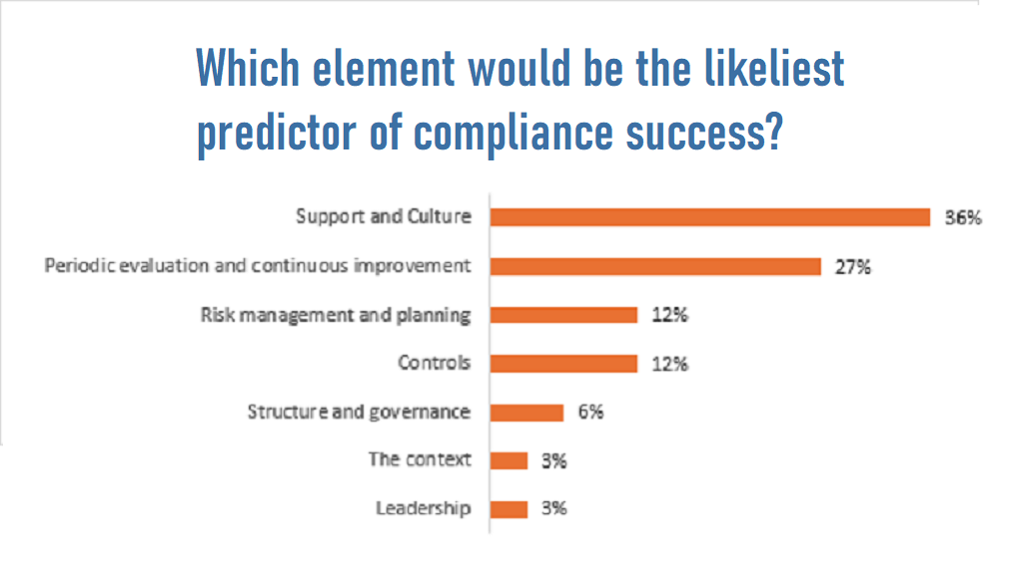

To a poll question on the likeliest predictor of compliance success, 36 per cent of the attendees chose Support and Culture, followed by 27 per cent in favour of Periodic evaluation and continuous improvement.

Source: Poll conducted during the workshop

The final section underscored that the responsibility and accountability for compliance lies with everybody within the organisation, noting tha several regulators have provided guidelines on accountability and conduct and impose severe liabilities on compliance failures.

Attendees used the opportunity to seek opinions from Gail about compliance issues within their organisations.

All attendees received a Fintelekt-Asian Bankers Association Certificate of Completion for participating in the workshop.

Leave a Reply