The Vietnam Bank for Agriculture and Rural Development (Agribank) in association with the Asian Bankers Association held a webinar on “Agribank’s Role and Contribution in the Development of Financial Inclusion in Agriculture and Rural Areas” on August 29, 2023.

With more than 300 participants from 26 countries, the 60-minute webinar featured Ms. Pham Thi Huong Giang, Deputy Director of Financial Institutions Department who presented Agribank’s agricultural policies, its key financial indicators, and plans implementing financial inclusion in agricultural and rural areas of Vietnam to reduce poverty.

The session was moderated by Joseph Daniel N. Lumain, VP of Microfinance & Financial Inclusion Group Head at Rizal MicroBank, Inc. – A Thrift Bank of RCBC.

SUMMARY

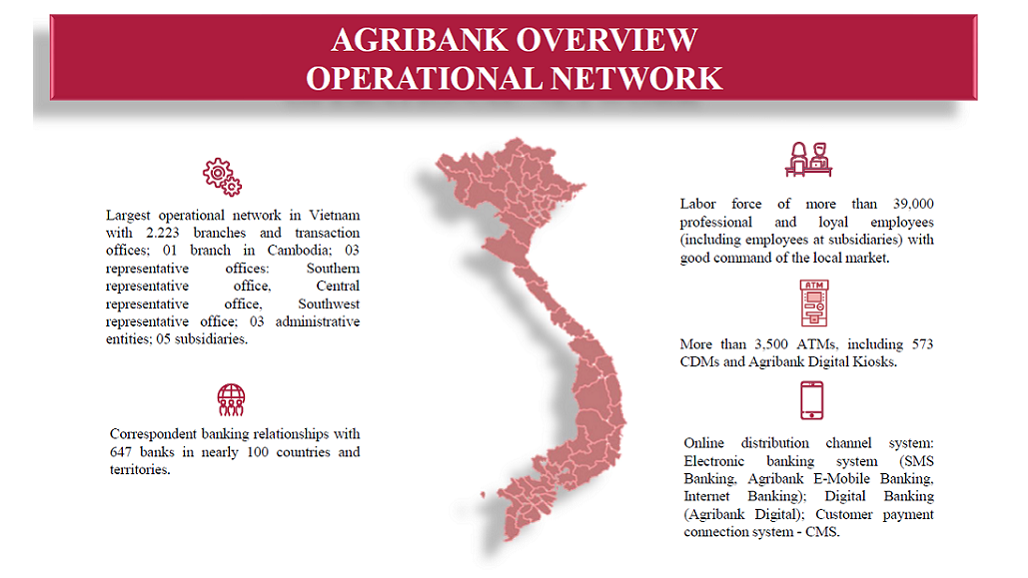

Agribank has the largest operational network in Vietnam with 2.223 branches and transaction offices; 1 branch in Cambodia, 3 representative offices, and 39,000 employees nation-wide. Agribank’s main objectives are to contribute to the reduction of hunger and poverty, and to promote job creation and better livelihood for people in agricultural, rural, remote and isolated areas.

Its key financials stand at:

- Total Assets: VND 1,899,955 billion (~USD 80.61 billion) (increased by 1.4% compared to 31 December 2022)

- Outstanding loans to the economy: VND 1,461,056 billion (~USD 61.99 billion) (increased by 1.35% compared to 31 December 2022)

- Profit before tax: VND 13,201 billion (~USD 560.07 million)

Agribank’s outstanding loans in agriculture and rural areas account for 65-70% of the total outstanding loans to the economy. As of 30 June 2023, Agribank had more than 2.8 million customers in agriculture and rural sector with the total outstanding loans of over 925 trillion VND.

Agribank provides credit support by offering lower lending rates to prioritized entities in agricultural production through multiple preferential credit packages for small and medium enterprises and agriculture households.

Agribank actively contributes to social welfare by sponsoring the construction of hundreds of schools, medical stations and thousands of charity houses for the social-policy beneficiaries and impoverished households across the country.

Agribank’s financial inclusion strategy includes:

(1) Developing a variety of financial products and services towards financial inclusion;

(2) improving knowledge and skills on financial management, and

(3) enhancing the awareness of financial products and services to the people and businessess

PRESENTATIONS & VIDEO

The PDF copy of all the presentations is available only to ABA members.

The recording of the webinar can be viewed at ABA Youtube Channel below:

Leave a Reply