The Asian Bankers Association (ABA), the Association of Credit Rating Agencies in Asia (ACRAA) and CRD Association presented the very successful webinar on “Enhancement of Banks’ Lending and Credit Risk Assessment: Scoring Model Using Machine Learning & Transaction data” on 13 April, 2022 at 2PM Taipei time.

The ninety-minute session gathered more than 497 registered participants from all over Asia and featured Jiro Tsunoda, Senior Advisor CRD Association Japan (Former Principal Portfolio Management Specialist, Asian Development Bank), and Dr Lan Nguyen, Deputy Director, International Department CRD Association Japan (Former Research Associate, Asian Development Bank Institute).

Megumi Sagara, Director, International Department, CRD Association Japan and Dr. Khaliun Dovchinsuren, Senior Analyst International Department, CRD Association Japan joined Mr. Tsunoda and Dr. Lan Nguyen during the Q&A session.

We are pleased to present the summary of the presentations, the presentation files and the video available as follows:

SUMMARIES

(1) Mr. Jiro Tsunoda’s key takeaways:

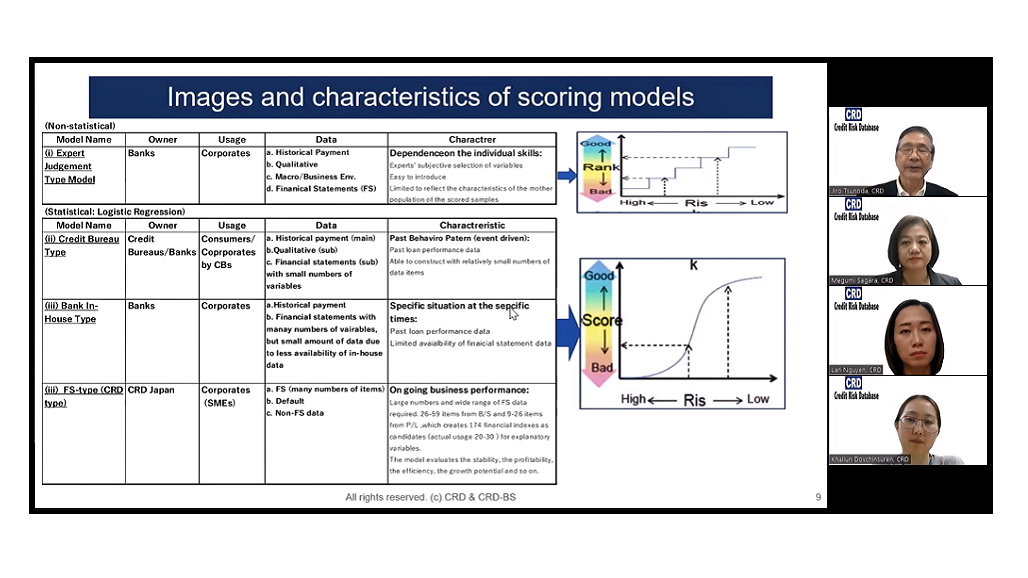

- There are several types of scoring models currently prevailing such as (i) the expert judgement type, (ii) the credit bureau type, (iii) the bank in-house type, and (iv) the FS-CRD type. Each scoring model has its own characteristic, which arises from the availability and the selection of the data to be used.

- CRD type of scoring model uses anonymized and digitalized data comprising of (i) financial statements (FS) (ii) default and (iii) non financial statements of MSMEs using logistics regression methodology.

- CRD system established in 2001 has carried on a win-win link between banks and CRD in maintaining a large size of the database and the accurate / stable credit scoring model.

- CRD type of the scoring model is considered the best and the most skillful approach for analyzing on-going business performance of borrowers from financial statements with respect of stability, profitability, efficiency, and growth potential.

- CRD Association introduced an up-to-date scoring model using transaction data with the machine learning methodology. This can evaluate MSMEs without FS and monitor the performance with higher frequency.

(2) Dr. Lan Nguyen’s key take aways:

- Data exploration:

Transaction data: available within the bank. Large scale, accurate. - Model selection:

Avoid black box.

Avoid underfitting and overfitting (by cross validation). - Model assessment:

Interpretability, Accuracy (AUC), Stability (out-of-sample validation) à Maintenance. - POC:

Easy way to test a model with your own data before actual deployment.

PRESENTATIONS

The two presentations (in PDF format) of the session can be downloaded HERE.

III. VIDEO

The video recording of the webinar can also be viewed at the ABA Youtube Channel

Leave a Reply