A worker pauses during the construction of the new HQ building of Chinese travel agent, CTYS Central Beijing. Insurance pricing in the second quarter in Asia increased 3%, on average, the same as in the prior quarter.

Photo: Ben McMillan/Construction Photography/Avalon/Getty Images

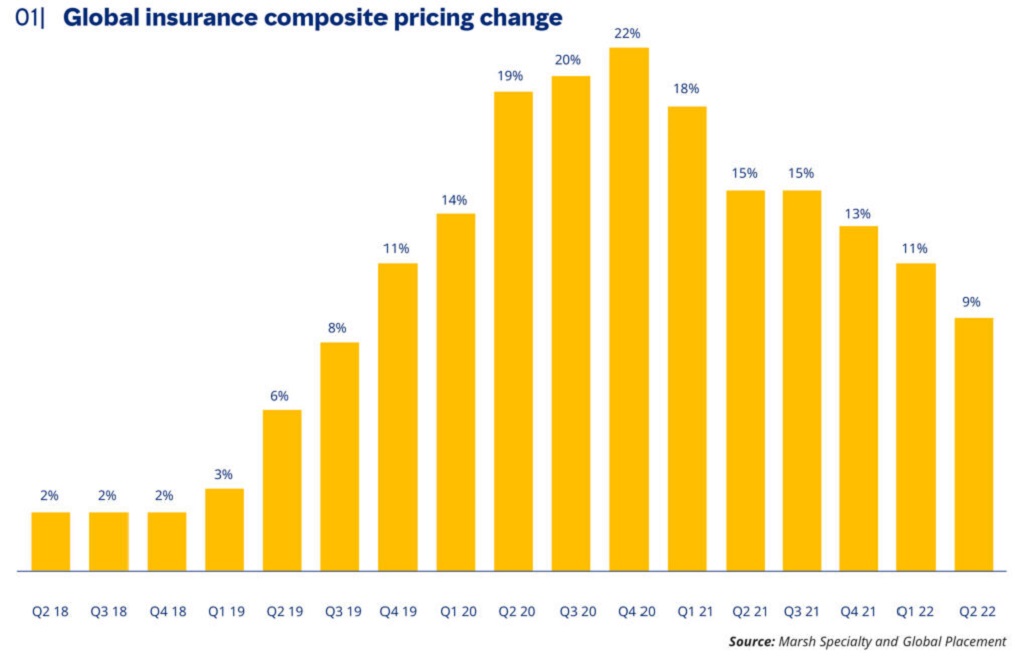

Global commercial insurance prices increased 9%, on average, in the second quarter of 2022, a decline from 11% in the first quarter. It was the nineteenth consecutive quarter of rising average pricing rates in the Marsh Global Insurance Market Index; increases peaked in the fourth quarter of 2020 at 22% and have generally slowed or remained flat since (see Figure 1).

Global commercial insurance prices increased 9%, on average, in the second quarter of 2022, a decline from 11% in the first quarter. It was the nineteenth consecutive quarter of rising average pricing rates in the Marsh Global Insurance Market Index; increases peaked in the fourth quarter of 2020 at 22% and have generally slowed or remained flat since (see Figure 1).

Cyber insurance continued to be challenging both from a pricing and a coverage perspective. However, while cyber insurance pricing rates continued to rise significantly, the pace of increase slowed in the quarter, to 79% in the U.S. and 68% in the U.K., compared to 110% and 102%, respectively, in the prior quarter.

The U.K. and U.S. had the highest average composite insurance pricing increases: 11% in the U.K., compared to 20% in the first quarter, and 10% in the U.S., compared to 12% in the prior quarter.

Average pricing increases in the Latin America and Caribbean (5%) and Pacific (7%) regions were lower than in the prior quarter; Continental Europe (6%) and Asia (3%) were the same.

All three major product lines showed increases in average pricing globally, though less than in the prior quarter for financial and professional lines (16%) and property (6%), with casualty higher (6%). Cyber insurance pricing drove the increases in overall financial and professional lines pricing. For example, in the U.S. — excluding the impact of cyber — financial and professional lines pricing actually decreased in the low-single digits in the second quarter.

US Property Insurers Focus on Valuations

The rate of price increases in the U.S. in the second quarter was 10%, the same as in the first quarter.

Average property insurance pricing in the U.S. increased by 6% in the quarter, compared to 7% in the first quarter. Valuation has become a focal point for property insurers, driven by concerns about inflation, supply chains and labor shortages, as well as loss experience in cases where adjusted loss amounts were well above reported values. Clients with poor risk quality, meaningful losses, or significant exposure to secondary catastrophe perils — including wildfire, convective storm and flood — generally experienced above-average rate increases.

Financial and professional lines pricing in the U.S. increased an average of 21% in the quarter, a decline from 28% in the prior quarter. The average was affected significantly by cyber insurance pricing. Directors and officers liability insurance pricing for publicly traded companies decreased 6%, compared to a 3% increase in the prior quarter.

Cyber insurance pricing continued to be affected by the increase in frequency and severity of losses, although average pricing declined in the quarter. Additional insurers have entered the cyber insurance market, increasing competition. Insureds with strong cybersecurity controls may see prices stabilizing if they have previously experienced significant rate adjustments.

Casualty insurance pricing in the U.S. increased 6%, on average, in the second quarter, up from 4% in the first quarter. Insurers continue to watch loss trends as the impact of courts being closed during earlier stages of the pandemic subsides.

UK Pricing Increases Moderating

Overall, average insurance pricing in the second quarter of 2022 in the U.K. increased 11%, compared to a 20% increase in the prior quarter.

Financial and professional lines pricing declined in some products, although the overall average pricing increased due to the impact of continued increases in cyber insurance. D&O liability insurance pricing declined in the single digits.

As elsewhere, cyber insurance rates climbed at a slowing pace, with an average increase of 68% in the second quarter, compared to 102% in the prior quarter.

In other coverage areas, property insurance pricing increased 6%, on average, down from 9% in the prior quarter; casualty rose an average of 4%, compared to 3% in the first quarter.

Casualty Insurance Pricing Declines in Asia

Insurance pricing in the second quarter in Asia increased 3%, on average, the same as in the prior quarter.

Casualty insurance pricing was flat on average, compared to a 2% increase in the previous quarter. Insureds with good loss histories generally experienced flat pricing, while those with poor loss histories experienced increases.

Property insurance pricing rose 2%, the same as in the first quarter. It was the fifteenth consecutive quarter of average property insurance pricing increases, which peaked at 18% in the third quarter of 2020.

Financial and professional lines pricing in the region rose an average of 13%, the same as in the prior quarter.

Regional Highlights

Other regional highlights in the second quarter included the following

In the Pacific region, pricing increased 7%, on average, the sixth consecutive quarter that pricing increases have declined. D&O insurance declined 5%, on average, the first reduction in that product line in the region since 2017.

Continental Europe experienced a 6% average increase in overall composite insurance pricing, the same as in the first quarter. D&O liability insurance pricing was stable, with increased competition as new capacity entered the market. Property insurance rates increased 6%, on average, the same as in the prior quarter; casualty increased 7%, up from 6%.

In the Latin America and Caribbean region, composite pricing rose 5%, on average, down from 6% in the prior quarter. Casualty pricing rates increased 4%, on average, the first increase since the first quarter of 2020.

Lucy Clarke

Lucy Clarke

President of Marsh Specialty and Global Placement

The original report can be read at the Brink’s website HERE.

Leave a Reply