Mizuho Bank, Ltd. has arranged a project finance deal to build, maintain, and operate the Eoliennes Flottantes du Golfe du Lion Project (the “Project”), the floating offshore windfarm project in France, which is jointly financed by Mizuho Bank, other commercial banks, and the European Investment Bank as Mandated Lead Arrangers with EKF Denmark’s Export Credit Agency as the guarantor.

Mizuho Bank, Ltd. has arranged a project finance deal to build, maintain, and operate the Eoliennes Flottantes du Golfe du Lion Project (the “Project”), the floating offshore windfarm project in France, which is jointly financed by Mizuho Bank, other commercial banks, and the European Investment Bank as Mandated Lead Arrangers with EKF Denmark’s Export Credit Agency as the guarantor.

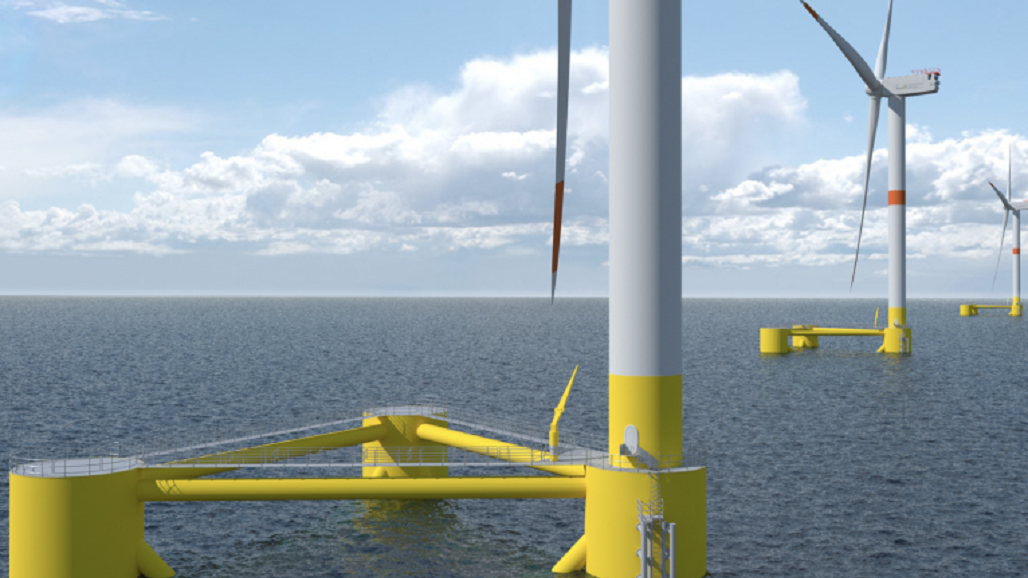

For this project, Ocean Winds1, and Banque des Territoires (groupe Caisse des Dépôts) formed a Special Purpose Company (SPC), Les Eoliennes Flottantes du Golfe du Lion, were awarded as a developer in November 2016 and has been developing the project since then. The Project will install three wind turbines with semi-sub floater off the coast of Leucate in Mediterranean Sea and sell the electricity under French FiT regime. The capacity of the windfarm is approximately 30MW.

The Project has been financed via an innovative project finance structure to pre-commercial floating offshore wind, developing a first of its kind non-recourse financing to be noted as the precedent in coming years.

The global offshore wind sector has experienced very rapid growth over the past five years. By the end of 2020, installed capacity of global offshore wind had risen to 35 GW and is expected to grow to 270 GW by 2030.

In particular, floating offshore wind is important for Japan since there are few shallow water and floating offshore wind is more suitable for deeper sea. Global floating offshore wind is still at early stage with total installed capacity at 73MW and this project will contribute to future market growth as a pioneer.

Mizuho will utilize our extensive power industry know-how and our track record in the field of project finance to support technological innovation and the development of renewable energy around the world, thus promoting action to address climate change and supporting the transition to a low- carbon society.

Mizuho News

Leave a Reply