![]() The Asian Bankers Association and Fintelekt Advisory Services jointly presented the webinar on Money Laundering and Terrorist Financing Risks in Correspondent Banking on July 8, 2020. The webinar convened an audience of over 600 registered participants from 30 countries.

The Asian Bankers Association and Fintelekt Advisory Services jointly presented the webinar on Money Laundering and Terrorist Financing Risks in Correspondent Banking on July 8, 2020. The webinar convened an audience of over 600 registered participants from 30 countries.

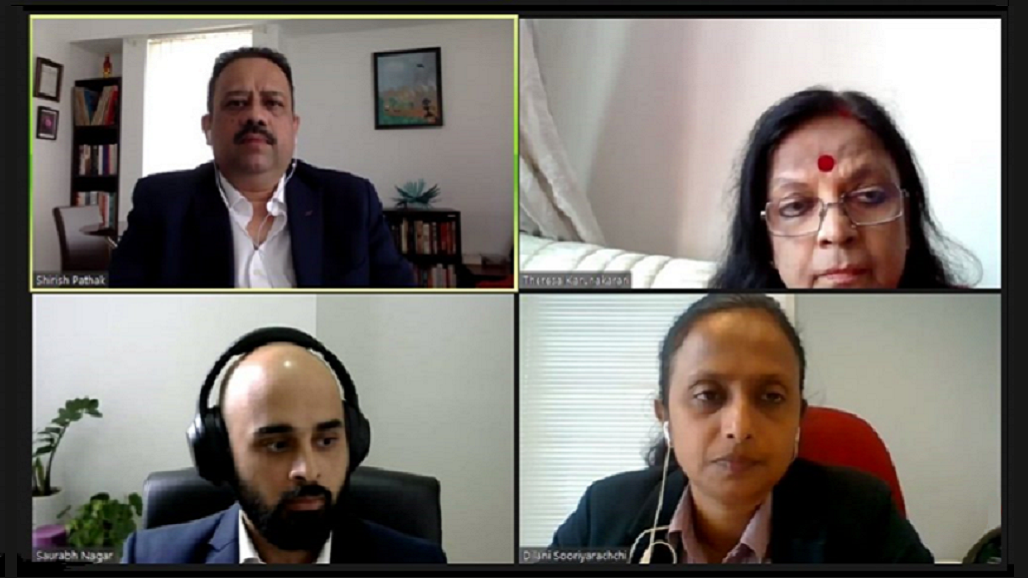

The webinar hosted by Shirish Pathak, Managing Director, Fintelekt Advisory Services counted with the participation of three expert panelists:

(1) Dilani Sooriyaarachchi, Head of Compliance, Seylan Bank

(2) Theresa Karunakaran, Director Compliance – Regulatory Affairs, Deutsche Bank AG

(3) Saurabh Nagar, Director, Business Solutions Group, APAC, Accuity

The hour long conversation allowed the three experts discuss the issues and problems affecting Money Laundering and Terrorist Financing Risks in Correspondent Banking. The overall conversation could be divided in 8 themes:

(1) ML/TF Risks in Correspondent Banking

The conversation started with the panelists emphasizing the importance of correspondent banking relationships to the overall economic development of a country, and its correlation to GDP growth, especially on developing economies.

“Correspondent banking is essential for developing economies to have access to global markets and foreign investments. De-risking has an impact on livelihoods and on the economy of affected countries.“

Theresa Karunakaran, Director Compliance – Regulatory Affairs, Deutsche Bank AG

Despite its evident benefits, correspondent banking is considered inherently high-risk for a variety of reasons: (1) A detailed view of the customer’s customer is not always available in a correspondent banking relationship and (2) banks have to rely on the partner bank’s ability to know their customer, thus it is required to conduct enhanced due diligence and to establish adequate internal controls.

(2) Enhanced Due Diligence

The panelists emphasized that the high-risk nature of the correspondent banking business requires that enhanced due diligence is executed with regular frequency.

Saurabh Nagar introduced the three key questions guiding the due diligence for a correspondent banking transaction:

(1) Who is my customer?

(2) Should I do business with this customer?

(3) Can I do business with this customer?

He argued that while issuing the questions appear simple, answering these questions is not easy because it involves finding out if the entity is sanctioned or PEPs, establishing ownership structures, identifying beneficial ownership, nested relationships, payable through accounts and other risks that exposes the bank to risks.

This enhanced Due Diligence is a time-consuming and expensive process that demands extensive data collection and analysis.

It is recommended that the final decision on whether to do business should depend on the risk-based approach elaborated by the individual bank.

“Based on our surveys, the time taken to perform due diligence and conclude whether to go ahead with a customer relationship can be anywhere between 12 hours and 28+ hours”

Saurabh Nagar, Director, Business Solutions Group, APAC, Accuity

(3) The Wolfsberg CBDDQ

One fundamental reference recommended during the discussion was the new Wolfsberg Correspondent Banking Due Diligence Questionnaire (CBDDQ) which was introduced in April 2020. According to the experts, CBDDQ is quite exhaustive and has expanded the scope of due diligence significantly by introducing a lot of granularity.

Banks in countries that do not have equally stringent AML measures may find it difficult to meet the standards expected by correspondent banks and may get subjected to de-risking.

(4) De-risking and its Impact

The process of de-risking for a financial institutions involves the termination of relationships mainly for the next following reasons: (a) risk appetite of the organisation, (b) profitability, (c) reputational risk, (d) regulatory burden on AML/CFT compliance, (e) penalties, (f) criminal prosecution.

While assessing and reducing risk is always a good policy, The idea of blanket De-risking is unwise because it has a negative impact of trade growth and business opportunities.

Countries that are completely de-risked, still face the need of executing transactions. Consequently, they will develop commercial opportunities through unregulated channels. Unfortunately, more negative consequences will affect the financial institutions in that market such as diminished payment transparency, which could ultimately lead to financial exclusion.

(5) Adopting a Risk-Based Approach

Dilani Sooriyaarachchi mentioned the importance of several international bodies such as the Financial Action Task Force (FATF) and the Basel Committee on Banking Supervision because they have been working to develop robust mechanisms to improve the transparency of international transactions.

She further added that in 2016, FATF issued guidelines on correspondent banking focusing on de-risking urging banks to adopt a risk-based approach and to conduct due diligence on correspondent banking customers including assessments of regions, and the products/ services being offered.

(6) Pressure from Correspondent Banks

“In Sri Lanka following the gray listing by FATF in 2017, the regulator took the fear of de-risking very seriously and made tremendous efforts to improve risk-based supervision and outreach to financial institutions, improve international co-operation, strengthen the legal framework, and enhance the implementation of UNSCRs”

Dilani Sooriyaarachchi, Head of Compliance, Seylan Bank

The overarching fear is correspondent banking relationship is the possibility of transferring illegal funds to respondent banks in countries with relatively weaker AML policies as they depend on the correspondent bank’s reputation to process the funds. Hence correspondent banks put their respondent partners through higher degree of scrutiny and monitoring to establish the integrity of financial transactions.

Thus the need for the Correspondent banks to put in place a mechanism to reach out to the respondent bank when there is suspicion on the nature of the transaction and get information about the transactions quickly.

The risk-based approach can help eliminate the need for blanket de-risking. The use of latest tools and technology and all available data points can help banks make more efficient decisions.

(7) Responsibilities of Correspondent Banks

(7) Responsibilities of Correspondent Banks

As part of the overall financial community, banks on both sides of the transaction must share the responsibility towards fostering economic opportunities, increase financial inclusion and fight financial crime together.

Theresa Karunakaran explained that Due diligence should not be a mere paper-gathering exercise. Banks have a responsibility to use due diligence to adopt a risk-based approach in a holistic manner while making their decisions.

Regulators in jurisdictions with stronger AML controls often advise extra caution when banks enter cross border transactions, however they do not advise blanket de-risking. Often times they are open to and willing to support efforts to bring AML processes in respondent banks up to speed.

(8) Best Practices for Correspondent Banking Due Diligence

One fundamental lesson derived from the fruitful conversation is that Best Practices in the Banking Due Diligence rest on 4 key factors that every bank is encouraged to cultivate:

People – invest in skilled personnel and provide on-going training

Risk assessment – maintain a strategic profile of the respondent bank with on-going monitoring to provide a holistic risk assessment. This should consider the country risk, sector or industry risk, name screening on institutions, check beneficial owners, check for nested relations, check against negative lists

Technology – use technology to reduce time consuming and manual work which is prone to human errors

Work together – have a hand-holding approach with the partner bank – including having pragmatic and reasonable processes that match the need of the respondent bank’s country.

A full recording of this webinar is available at the ABA YouTube channel.

Leave a Reply