The Asian Bankers Association (ABA) and LexisNexis® Risk Solutions, an ABA Associate Member, held a very successful webinar on “Money Mules: The enablers of scams” on 20 March 2025 that gathered 1,134 registered participants from over 52 countries, with a stable 71% live participation throughout the session.

The 60-minute session featured Thanh Tai Vo, Director of Market Planning, Fraud & Identity APAC at LexisNexis Risk Solutions, and panelist Gabby Tomas IV, Senior Vice President, Operations Group Head at Rizal Commercial Banking Corporation (RCBC) from the Philippines. The moderator was Michael Grover, FCIB, Regional Director, Greater Mekong Region, Singapore at Qorus.

(1) Presentation summary

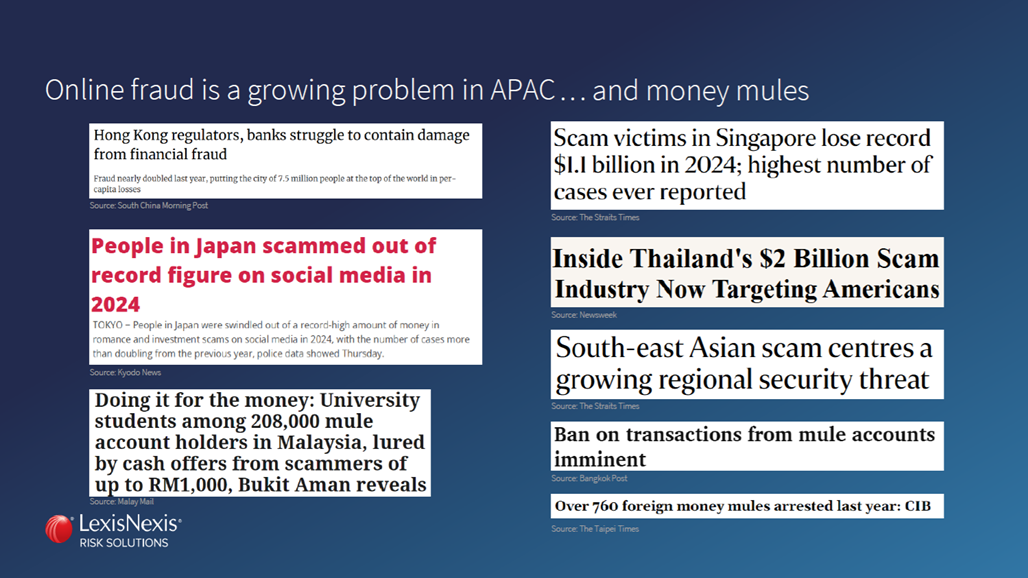

Thanh Tai Vo explored the pivotal role money mules play in channeling illicit funds from scams to cybercriminals, emphasizing their impact on digital banking fraud across the Asia-Pacific (APAC) region. He outlined how mules obscure the trail of fraudulent proceeds through complex networks of accounts, often leveraging social engineering tactics like fake job offers, romance scams, and coercion to recruit individuals—both complicit and unwitting. Vo highlighted the sophistication of modern fraud, with APAC seeing a 61% rise in human-initiated attacks and 55% in bot attacks year-on-year, driven by tactics such as authorized payment fraud, including investment and impersonation scams.

Leveraging LexisNexis’s Digital Identity Network, which analyzes 124 billion annual transactions, he advocated for a multi-dimensional fraud prevention strategy using machine learning, behavioral analytics, and cross-industry intelligence to detect mules. The webinar underscored the need for collaboration among financial institutions, regulators, and technology providers to disrupt these networks and mitigate the escalating fraud threat.

Among the many important issues presented, there are 8 key points to remember:

- Money mules enable scammers by transferring illicit funds often from scams like phishing and investment fraud.

- Recruitment tactics include job scams, romance fraud, impersonation, and blackmail, targeting vulnerable groups.

- APAC faces rising fraud sophistication, with significant increases in human and bot-driven attacks.

- Three mule types exist: complicit (knowing participants), witting (recruited under false pretenses), and unwitting (unaware victims).

- LexisNexis’s Digital Identity Network tracks 5 million daily fraud attacks, informing risk assessments.

- Detection requires analyzing digital, physical, and behavioral data across sender and beneficiary accounts.

- Collaborative intelligence and advanced tech like AI are essential to disrupt mule networks.

- Authorized payment fraud, where victims send money willingly, is a growing challenge in Singapore and Australia.

(2) Panel summary

The panel discussion delved into the alarming rise of money mules and their role in facilitating scams across the Asia-Pacific (APAC) region, building on Thanh Tai Vo’s presentation, which highlighted 5 million daily fraud attacks and the use of advanced analytics to combat them.

Vo emphasized that even sophisticated financial hubs like Hong Kong, Singapore, and Japan are not immune, driven by affluent consumer bases and technological advancements that erode barriers like language through AI tools such as voice cloning. Gabby Tomas IV added a Philippines-specific perspective, noting how financial inclusion efforts inadvertently enable mule networks, with rural account holders selling credentials for as little as $10 due to economic vulnerability.

The panel agreed on the need for multi-layered fraud prevention, including digital identity monitoring and behavioral analytics, while stressing collaboration between banks, regulators, and tech providers. They discussed regulatory efforts, such as the Philippines’ new law criminalizing credential sales and Singapore’s shared responsibility framework, alongside consumer education challenges, especially in reaching rural populations. The conversation also touched on mules’ potential links to terror financing, the exploitation of human greed, and the evolving threat from both sophisticated syndicates and amateur scammers using accessible fraud tools.

Key points from the panel discussion:

- Financial hubs like Hong Kong, Singapore, and Japan face rising scam threats due to wealth and connectivity, worsened by AI overcoming traditional barriers.

- In the Philippines, financial inclusion drives mule activity, with rural individuals selling credentials cheaply, necessitating better monitoring and bank cooperation.

- Regulatory measures, like the Philippines’ criminalization of credential sales and Singapore’s liability-sharing model, aim to curb mule networks.

- Consumer awareness is critical but challenging, especially in rural areas, requiring vigilance beyond regulatory efforts.

- Technology, including digital identity, biometrics, and transaction slowdowns, is key to detecting mules, though fraudsters continually adapt.

- Money mules may facilitate terror financing, though detection relies on tokenized data and risk signals rather than specific case identification.

- Human greed fuels mule recruitment, with young adults (20-40) surprisingly the largest scam victim group in APAC, alongside targeted elderly populations in Japan.

- Collaboration across banks, regulators, and tech firms like LexisNexis is essential to shrink the operational space for scammers, from amateurs to organized networks.

A copy of the presentation is available only to ABA members.

The video recording of the webinar can be viewed at the ABA YouTube.