On June 15, 2023, the Asian Bankers Association (ABA) and the International Compliance Association (ICA) held a webinar on “Managing Compliance Risks in 2023” that drew a record-breaking 1,659 registered participants from 55 countries.

Moderated by Pekka Dare, Vice President of ICA, the 69-minute session featured as Speaker Md. Masud Rana, Additional Director of the Bangladesh Financial Intelligence Unit, an expert with 18 years field experience in the Bangladesh financial market and consultancy assignments in several countries in Asia.

The session, which was held in a fireside chat format, addressed the most critical financial crime and compliance risks facing banks and strategies to mitigate these risks. The agenda covered various aspects of compliance and financial crime, including recent regulatory shocks and lessons learned from notable failures in the industry.

SUMMARY

Following is a summary of four key questions discussed during the session:

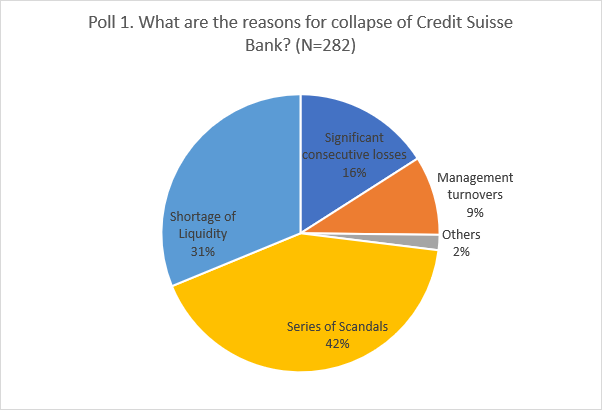

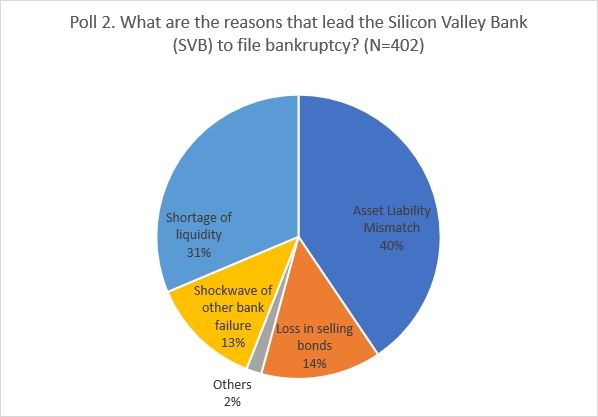

Question #1 focused on the reasons for the collapse of Credit Suisse Bank, while Question #2 explored the reasons behind the bankruptcy filing of Silicon Valley Bank.

The fireside conversation, facilitated by Pekka, commenced with leading questions addressed to Masud.

The first question delved into the most critical financial crime and compliance risks organizations face in light of recent regulatory shocks caused by SVB, FTX, and Credit Suisse debacles. Attendees were particularly interested in identifying areas that require special attention and mitigation efforts, such as corruption.

Question #2 focused on SVB’s downfall and its primary causes. Attendees sought insights from Masud regarding similar examples from Bangladesh. The discussion aimed to shed light on the factors contributing to failures in the banking industry.

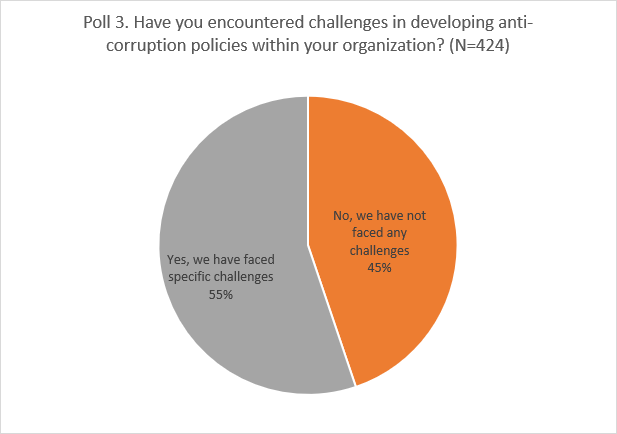

Question #3 also presented in a poll format answered by the audience provided further insights into the attendees’ perspectives on financial crime and compliance risks.

The conversation then shifted to the importance of effective financial crime compliance policies and emerging risks in this domain.

Masud shared his experience and recommended strategies and best practices for developing robust financial crime compliance policies. Attendees were made aware of specific challenges they should consider during this process.

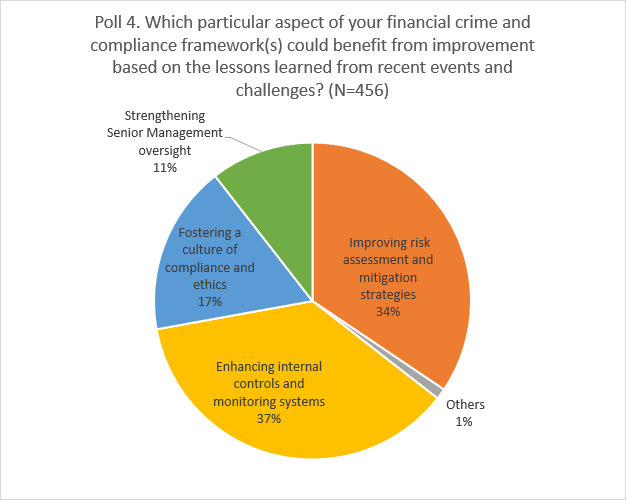

Question #4 shown below was also submitted to the audience, and the answers were discussed to identify areas within financial crime and compliance frameworks that could benefit from improvement based on lessons learned from recent events and challenges.

During the Q&A session, the audience had the opportunity to seek further clarification and explore additional topics related to compliance risks.

In the quickfire practical takeaways segment, Pekka asked Masud to provide actionable suggestions for the attendees to consider in the coming days, weeks, and months to manage compliance risks effectively.

In conclusion, the webinar provided valuable insights into managing compliance risks in 2023 and provided the audience with several valuable Key Takeaways such as:

- Organizations need to strengthen their compliance culture

- Continuous improvement of financial crime and compliance programs

- Leverage technology and data analytics

- Enhance collaboration with regulators and law enforcement agencies

- Consider transitioning to an intelligence-led approach in combating financial crime

- And, use Common Sense during your analysis

The rise of social media and its impact on the financial crime landscape was also discussed during the Q&A session.

Overall, the event successfully addressed the challenges and strategies for managing compliance risks, equipping the attendees with valuable knowledge and practical takeaways to navigate the evolving compliance landscape in 2023 and beyond.

We invite readers to view the whole video recording of the webinar at the ABA YouTube channel:

Leave a Reply