Fintelekt Advisory Services Ltd. and Asian Bankers Association presented the webinar on The Cost of Financial Crime Compliance in APAC on July 20, 2022. More than 850 participants from across 45+ countries were registered for the webinar.

The webinar was moderated by Arpita Bedekar, Director – Strategy & Planning, Fintelekt Advisory Services and the speakers were:

- Sharon Pamplona, Head of Financial Crime and MLRO, ANZ Hong Kong

- Rika Astari, AML/CTF Compliance Expert / Consultant,

- David Haynes, Vice President, Asia Pacific, LexisNexis Risk Solutions

- David Zhuo, Market Planner, LexisNexis Risk Solutions

The webinar started with a presentation by David Zhuo on the findings from the True Cost of Financial Crime Compliance Study – 2022 APAC Edition published by LexisNexis Risk Solutions.

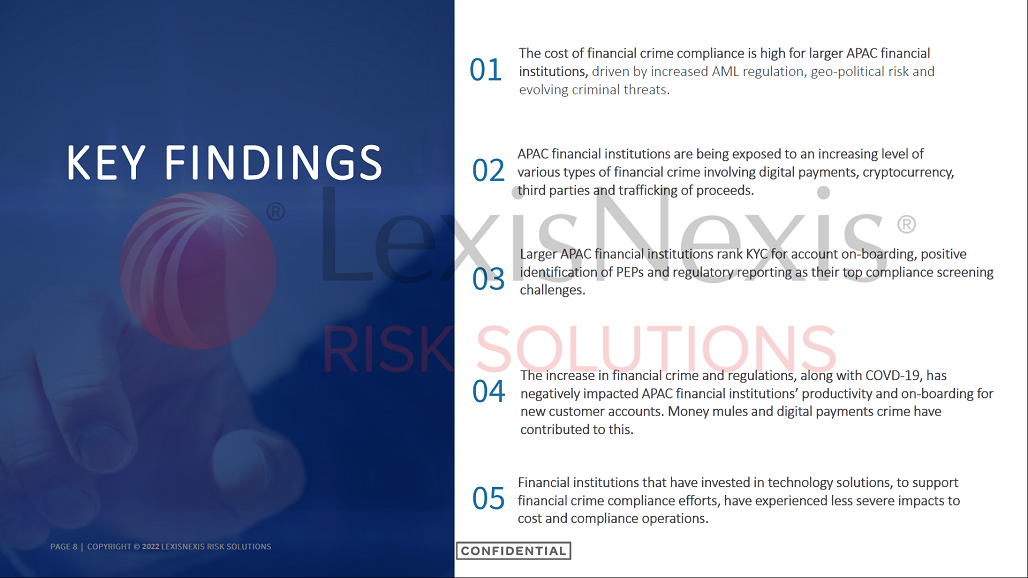

(1) Key Conclusions from the Report:

- The cost of financial crime compliance is high for larger APAC financial institutions, driven by increased AML regulation, geo-political risk and evolving criminal threats.

- APAC financial institutions are being exposed to an increasing level of various types of financial crime involving digital payments, cryptocurrency, third parties and trafficking of proceeds.

- Larger APAC financial institutions rank KYC for account onboarding, positive identification of PEPs and regulatory reporting as their top compliance screening challenges.

- The increase in financial crime and regulations, along with COVID-19, has negatively impacted APAC financial institutions’ productivity and onboarding for new customer accounts. Money mules and digital payments crime have contributed to this.

- Financial institutions that have invested in technology solutions, to support financial crime compliance efforts, have experienced less severe impacts to cost and compliance operations.

(2) Implications for Financial Institutions:

A multi-layered solution approach to mitigating risk and ensuring compliance is required, due to digital transformation of businesses.

COVID-19 pandemic, digital crime and increasing compliance pressures are pressing financial institutions to remain prepared for increased risks and costs associated with financial crime and compliance.

Skilled compliance professionals continue to be in demand as financial crime grows in complexity.

Essential to have robust and accurate data, through the support of expanded sources.

(3) Key Takeaways from the Panel Discussion:

The presentation was followed by a panel discussion with Sharon Pamplona, Rika Astari and David Haynes.

Some of the key takeaways from the panel discussion are:

- The talent crunch in compliance can be managed not just by investing in recruiting and training, but by developing the team and providing hands-on experience. Opportunities can be provided to people of all backgrounds and the organisation can invest in exposing them to various aspects of AML compliance.

“Banks can take a look at the talent available inside the organisation, that may not have vast experience but have the to learn and adapt quickly.” – Sharon Pamplona

- The fundamental challenges around screening have not changed much over the last few years. However, investments in technology have increased and can replace the largely manual processes. Technology is able to help reduce false positives and reduce backlogs of onboarding customer lists.

- The pandemic has led to an increase in AML risks in digital payments and virtual assets, as well as fraudulent ways of money laundering. Banks need to be extra cautious and deploy a risk-based approach while dealing with new players such as Virtual Asset Service Providers (VASPs). Continuous monitoring, updating transaction monitoring scenarios and parameters in the AML system is also required.

“Banks should ensure that they conduct adequate CDD and EDD, ensure that the VASPs that they are dealing with are licensed and under the supervision of relevant regulators to prevent the bank from facilitating illegal investments.” – Risk Astari

- There have been sharp increases in alert volumes and transaction volumes since the beginning of the pandemic. However, financial institutions have reacted sharply by leveraging more technology to clear the alerts much more quickly and effectively.

- Moving to a single view of the customer and bringing data from various departments and systems under a single roof is very challenging, especially for the large and traditional banks and financial institutions. Newer banks such as digital banks are at an advantage because they are able to invest in new technologies that can enable a single risk profile.

- Smaller institutions that are struggling to invest in technology should take a long-term view and can start in a small way by implementing a single use case and taking the advantage of scalable technology available today such as API based solutions.

“Embarking on the technology transformation journey rather than delaying it will benefit the organisation in the long run.” – David Haynes

(4) Webinar’s presentation PDF and video recording

A PDF copy of the presentation can be downloaded HERE.

A recording of the webinar is available on Fintelekt’s learning platform Fintelekt Academy HERE and in the ABA YouTube by just clicking below.

Registration on Fintelekt Academy is free and more than 80% of the content is free to view HERE.

Leave a Reply