Almost 600 registered participants from 22 countries and territories joined the webinar on “Cultural Landscape of AML Compliance” held on May 5, 2021. The audience, composed largely by AML experts in the banking sector, followed with interest the one hour session organized by the Asian Bankers Association (ABA) and Fintelekt Advisory Services, that featured experts from the Mizen Group.

Hereunder, we present the summary of the webinar:

(1) Summary Report on the webinar:

The webinar was moderated by Shirish Pathak, Managing Director, Fintelekt Advisory Services and the speakers were Patrick Kelly, CEO, Paul McCarthy, CTO and Dr. Katy Dineen, Senior Associate from The Mizen Group.

The speakers addressed the cultural landscape of compliance and how cultivating that culture can serve to improve a team’s mindset, skills, and appropriately manage risk while increasing business opportunity.

More specifically, they discussed what is a culture of compliance and why it is so important; recognizing different cultural environments: financial sector vs. corporates; the characteristics of a healthy compliance culture; how innovation and technology can be encouraged to serve compliance needs; and how to bring about cultural change whereby innovative thinking becomes the norm.

(1.1) Trends and Implications

To set the context for the discussion, Paul discussed some of the key trends in the financial services industry that include:

- Continued investment in Financial Technology companies (fintechs) despite the pandemic.

- Partnerships between financial institutions (FIs) and fintechs, which have become a critical element enabling organisations to drive their transformational strategies.

- Digital transformation, which has accelerated contactless mechanisms and ways of interacting with customers.

Some of the implications of these trends are in terms of greater compliance risks, operational and competency challenges which AML compliance professionals need to be aware of. Financial institutions are typically more conservative and careful at managing compliance risk, while fintechs tend to be more innovative and reactionary about regulatory /compliance obligations.

What this means for the eco-system which includes FIs and fintechs is that there is heightened regulatory awareness and concern which translates to a need to balance innovation and risks.

“The lack of a culture of compliance will only increase the vulnerabilities of financial institutions to cope with these trends. A healthy compliance culture on the other hand, would produce a benefit within organisations to reduce the risks and improve business outcomes.” – Paul McCarthy

(1.2) Regulatory Expectations on Culture

While regulators all over the world understand the importance of correct policy and procedure, they recognize that it is not enough to avoid poor regulatory outcomes. Regulators are focusing more and more on culture, leading to culture becoming particularly important.

Regulators find it difficult to keep up with the pace of innovation and their concern is for the threat faced by consumers and the harm that they can suffer from unregulated products. On the other hand, if laws are not fit for purpose for innovative fintechs, they can impede innovation. Regulators are aware that there needs to be more flexibility in the system in order to encourage innovation and yet safeguard the interests of consumers.

(1.3) What is culture?

The colloquial understanding of culture points to culture being unique and different. There is no one size fits all definition or understanding of what is the ‘right’ culture. However, despite the differences in the understanding of culture across countries and regions, there are shared characteristics of a healthy culture. Trust and trustworthiness are two of these common characteristics.

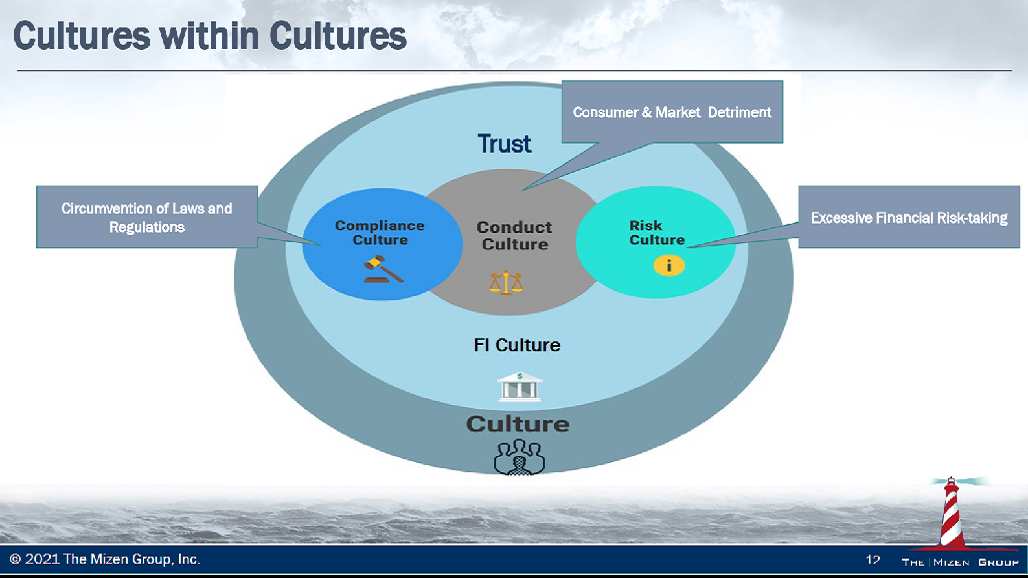

There are three aspects of culture present within and throughout organisations: conduct culture, risk culture and compliance culture. Culture refers to the beliefs and values latent within the organisation that support employees’ decision making and behaviour – and in the case of compliance culture, this means avoiding the circumvention of laws and regulations.

A healthy compliance culture has the characteristics of honesty, reliability, competence, inclusion, integrity and is values led as against being led by a procedure of ticking the boxes. A good culture has been recognized by regulators as leading to good regulatory outcomes.

“If organisations can get to know their own culture, they can know if there is a risk involved in that culture and they can also know the culture of their strategic partners.” – Dr. Katy Dineen

(1.4) Critical Success Factors for Good Culture

When in a partnership:

- Financial institutions need to:

Monitor potential compliance culture risk internally as they continue to innovate.

Monitor potential compliance risk culture of their strategic partnerships.

Understand cultural alignment and the influencers in the organization.

- Fintechs need to:

Demonstrate their compliance processes are embedded in the organization.

- Both need to:

Demonstrate improvement or sustainability after compliance initiatives or when introducing new products or services.

Measure and perform peer review to share competencies.

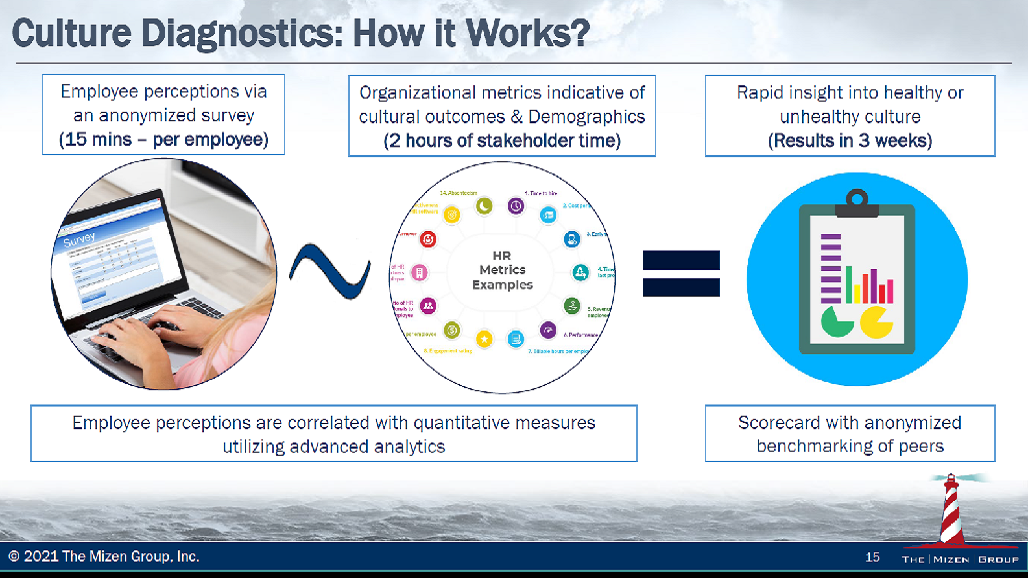

The Mizen Group offers a Cultural Diagnostic Tool, which is an employee perception-based survey that measures 9 dimensions and uses advanced quantitative tools to provide a culture scorecard on 5 different outputs to the organisation.

“The tone at the top is important, but equally important is how people at lower levels of the organisation both interpret and act upon what is being done. To measure culture, the perceptions of the individual participants throughout the FI need to be measured. It is insufficient just to hear the tone at the top.” – Patrick Kelly

A recording of the webinar is available on www.fintelekt.academy. Registration on Fintelekt Academy is free and more than 80% of the content is free to view. Visit https://fintelekt.academy/register/

(2) Webinar’s video and presentation file:

The recording of the webinar is available at the Fintelekt Academy HERE.

The presentation file can be downloaded HERE.

Registration in the Fintelekt Academy is FREE and more than 80% of the content is FREE to view. Please use it!

(3) Participation Certificates:

![]() Participation Certificates are available to participants who upgrade to Premium membership on Fintelekt Academy upon completion of a multiple-choice assessment.

Participation Certificates are available to participants who upgrade to Premium membership on Fintelekt Academy upon completion of a multiple-choice assessment.

Paid membership is available to ABA members for US$95 annual subscription – representing a 24% discount from the standard annual subscription of US$125 for ABA non-members. ABA members should write to ABA to get the Discount Coupon.

Paid members of the Fintelekt Academy can apply for Fintelekt-ABA webinars’ Certificates of Participation, at NO EXTRA COST for one year.

Leave a Reply