Paper documents may be in rapid decline in the financial world but they are being replaced by an even greater number of pdfs and other digital documents which takes time and effort to process. We live in a complex, regulated society where bankers, insurers, investment managers and other financial services professionals must keep track of every customer interaction and business decision. This creates huge “virtual” mountains of structured and unstructured data on everything from loan applications and payments, to insurance claims and investment portfolios, to regulatory compliance and risk management.

Although this data is gathered, managed and stored in a digital environment, it still requires high levels of human intervention and much of it is hard to locate, extract and analyse. Staff have to do it manually, which is time-consuming, costly and error-prone.

Today things are changing. More financial services firms are using artificial intelligence (AI) and automation technologies to process their documents and the data in them, because if they do not they will lose their competitive edge and their customers. Intelligent document processing is allowing firms to perform these tasks more quickly, accurately and efficiently while reassigning employees to customer-facing and other more valuable positions.

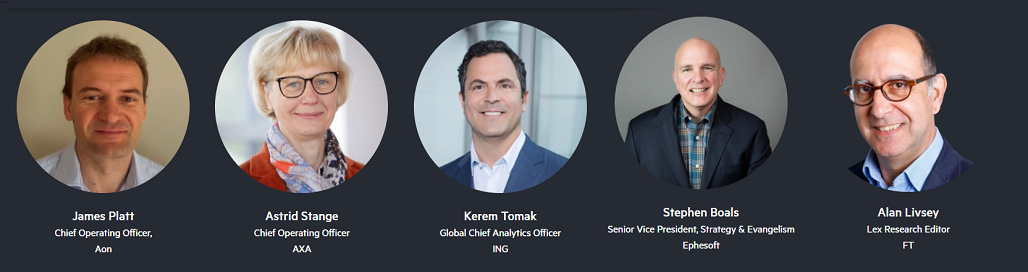

This live webinar, hosted by the Financial Times in partnership with Ephesoft, to be held Tuesday 27 April at 15:00 – 16:00 BST (GMT+1) will bring together a panel of senior financial services executives responsible for IT, digital transformation, lending, insurance underwriting and claims, investment advice and other areas. They will discuss the importance of having accessible data to improve the customer experience and how AI innovation is making it easier to capture, analyse and draw insights from that data, and give some real-life examples. The webinar will be available to view on-demand immediately after the live show ends.

Panel Discussion

- The data challenge. Just how much is there, and how difficult is it to collect, manage, analyse and use? How much data stays unused and why?

- AI to the rescue? How can artificial intelligence be used to capture and amplify the power of data contained in documents? In which product areas – such as lending, mobile payments, general insurance and wealth management – is intelligent document processing having most impact? Which processes in particular lend themselves to automated data capture?

- The employee and customer experience. How are AI-driven processes making life easier for both sides of the relationship, in areas such as customer on-boarding, credit referencing, anti-money laundering (AML) checks, know-your-customer (KYC) requirements, marketing, hyper-personalisation of services, cross-selling and customer retention?

- The technicalities. How does this AI-based technology work? Is it delivered via the cloud, on-premise, or a combination of both? How much training and coding expertise do staff need to use it? What technical problems can arise and how are they dealt with?

Register HERE.

Leave a Reply