On March 24th 2021, the Asian Bankers Association (ABA) and the Association of Credit Rating Agencies in Asia (ACRAA) jointly presented a webinar on Opportunities for green cooperation in the banking sector and financial markets for a greener and better new normal post-pandemic that convened almost 300 registered participants from 28 countries.

The webinar provided an opportunity to learn and gain insights from the presentations and subsequent discussions of the three experts speakers, Mr. Sakda Pongcharoenyong, President, TRIS Rating Co., Ltd, ; Ms. Stella Chang, Head of International Business, Golden Credit Rating International Co., Ltd (Golden Credit); and Ms. Atsuko Kajiwara, Head of Sustainable Finance Evaluation Dept., Japan Credit Rating Agency, Ltd. on the efforts by the Thai government, regulators, and financial market participants to accelerate sustainable finance in Thailand; on issues such as China’s commitment to climate change and how China is making efforts to encourage green bond issuers; and finally on the importance in realizing a carbon-neutral society, as global sustainable finance markets are focusing on how to move heavy CO2 emission industries to adopt cleaner solutions.

]

Summary of the Presentations

Hereunder are some key takeaways from the webinar:

(1) “Accelerating Sustainable Finance in Thailand” presented by Sakda Pongcharoenyong – President, TRIS Rating Co., Ltd.

As a signatory party under the Paris Agreement, Thailand has made significant efforts in mitigating the country’s Green House Gas (GHG) emissions with available resources and capabilities. Climate change is currently addressed at the highest policy level under the National Strategy to ensure a long-term continuity of the issue alongside other economic and social considerations. According to the country’s Nationally Determined Contribution Roadmap on Mitigation 2021 – 2030 (NDC Roadmap), Thailand targets to achieve GHG reduction by 20% from the business-as-usual level by 2030 (compared to a 2005 baseline).

The main source of carbon emissions was the energy sector, which was in line with energy consumption trend during the period. To address climate emergency, Thailand’s strategy to reduce GHG emissions have been focused mainly on emission reductions in the energy and transportation sector. This strategy is reflected by the country’s national power development plan that aims to increase renewable energy to about 27% of total energy consumption by 2037. The development plan to expand the electric train mass transit network in the Bangkok metropolitan area is another important part of the plan to reduce GHG emissions.

The transition to a more resilient and sustainable economy will require significant investments from the government and private sector. Public-Private-Partnership investment schemes are typical for large infrastructure projects that involve investments from the government and private project sponsors. Most infrastructure projects in Thailand are funded by the country’s domestic financial markets, in the form of commercial bank project loans for greenfield projects, and bond issuance in the debt capital market to fund project sponsors’ equity investments. There has been sufficient domestic liquidity to fund the investment projects.

In fact, there have already been substantial amounts of sustainable finance in Thailand, considering all the fund raisings to fund the on-going investments in renewable energy projects, electric train mass transit projects over the past decade. The challenge is to ensure these sustainable financing transactions are aligned with international standards. The labelling of sustainable financing transactions, in the form of green bonds or loans, sustainability bonds or loans, will help ascertain the widely accepted international standards of sustainable finance are adopted. The role of the regulators is to facilitate the labelling of green or sustainability financing transactions, as part of the ecosystem for sustainable finance.

The volume and number of green bonds issuance in Thailand have increased substantially over the past three years. The Thai government, through the Ministry of Finance, issued Baht 30 billion sustainability bonds in 2020 to fund one of the electric train mass transit projects and the relief package to alleviate the COVID induced economic hardship inflicted on vulnerable groups. The Thai Bankers’ Association launched their Sustainable Banking Guidelines, Responsible Lending in 2019, for banks to make sustainability an integral part of their business strategies and policies, with top management’s commitment to responsible lending.

(2) China’s Road-map to 2060 Carbon Neutrality Goal by Stella Chang – Head of International Business, Golden Credit Rating International Co., Ltd (Golden Credit)

China aims to achieve peak emissions before 2030, and carbon neutrality by 2060, which shows that China has linked low-carbon development with the country’s growing strategy. The pathway to achieve the target, will focus on five key sectors: electricity, industry, building, transportation, as well as agriculture, forestry and other land usages. According to 14th Five-Year Plan to end by 2025, China expects to reduce carbon dioxide emissions and energy consumption per unit of GDP from 18% and 13.5%.

In addition, China is also pursuing a more resilient economic system for Post-Covid19 Economy. The four pillars to support sustainable recovery, include “new” infrastructure investment, the construction of public health systems, major epidemic prevention and treatment systems, guide capital flow in traditional infrastructure towards green and energy efficient urbanization, as well as encourage green consumption.

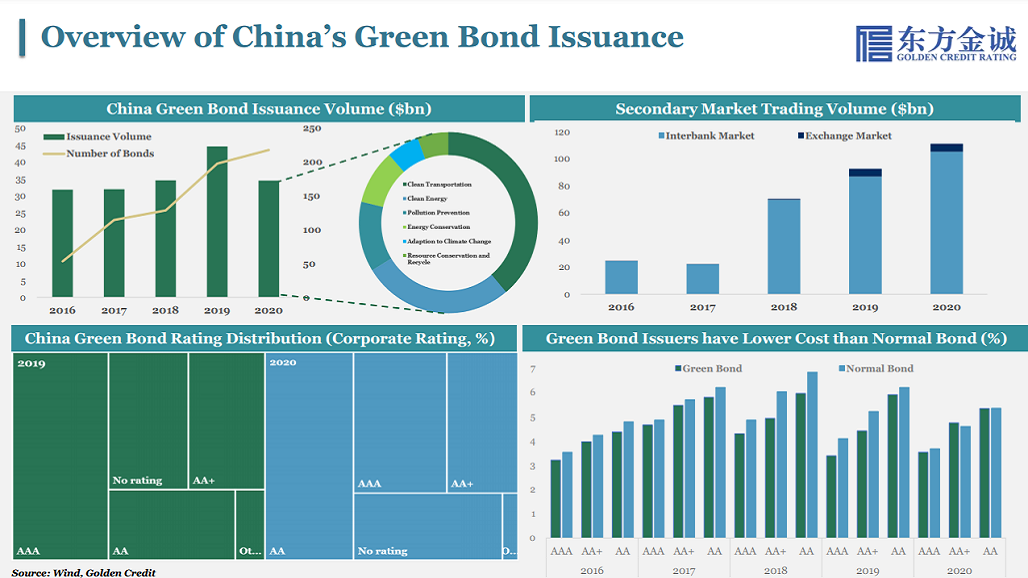

By the end of 2020, China has issued over 700 green bonds, totaling $180bn, or about 20% of global green bonds, to support the sustainable development. The top three inflowed from proceeds are allocated to clean transportation, clean energy, and pollution prevention and control. The green bond issuing is expected to double from 2020 to 2021 based on market consensus. Comparing with the large size of green bond issuing, the investment is still under the developing stage. China regulators are adopting incentive measures to attract more domestic and global investors, including increase the transparency, adopt de-risking mechanisms as well as align with international standards.

As climate actions are now more important than ever, the four pillars, in terms of regulatory incentives, global cooperation, green innovation and a green verification system, will play significant roles to achieve 2060 Carbon Neutrality Goal.

(3) Innovation and Transition to the Carbon Neutral World by Atsuko Kajiwara – Head of Sustainable Finance Evaluation Dept., Japan Credit Rating Agency, Ltd.

In October 2020, Japanese prime minister, Mr. Suga declared to realize carbon neutral society by 2050. This is not only the case in Japan, but those who attended this webinar will find that your own country probably has set long-term de-carbonization goals. Thus, our long term journey needs to support company’s transition strategy and innovation for greener technologies.

In Japan, the governments announced to accelerate Green finance, Climate Transition Finance and Innovation finance for realizing lower carbon society.

The road to reach zero carbon will not be linear, but it could experience discontinuous drastic innovations from time to time. As innovative technologies continue spreading into the market, then less carbon efficient societies will also move forward to the final goal of zero carbon.

In December 2020, International Capital Market Association published the handbook “Climate Transition Finance Handbook” that explains the importance of supporting companies’ transition pathway as climate transition finance.

Asia’s industrial structure is different from that of the EU. Asia has many manufacturing industries while EU imports our product without any CO2 emission.

Indeed, the manufacturing industry’s roadmap for carbon neutrality is very tough. Tremendous investment will be needed to innovate or transform into cleaner energy.

Therefore, a transition phase is needed to move smoothly forward to carbonless World with the support from financial institutions.

Climate transition finance is a framework for supporting companies which have to emit large volume of CO2 and have been facing difficulties in obtaining financing from sustainable finance market. In fact, it is possible to set a mid and long-term CO2 emission reduction target to reach carbon neutral with reliable investment plans.

I would like to request to the bankers and investors who joined this webinar that when considering the financing of a company that supports a carbonless objective, please review not only the proceeds’ usage but also the company’s long-term vision, pathway and investment plans.

By 2030, the world has to prevent a rise of 2 degree in temperature. According to the Paris Agreement, 1.5 degree rise in temperature is much preferable.

We definitely have to think about the most effective ways to move towards carbon neutrality in the long-run.

Webinar’s video and presentation files:

The 3 presentation files can be downloaded from the ABA website HERE.

The recording of the webinar is available at the ABA Youtube channel.

Leave a Reply