Over 450 registered participants from 15 countries joined the webinar on “Managing Business Continuity and Recovery During Covid-19 and Beyond” held on July 29, 2020.

Moderated by Dilshan Rodrigo, Chief Operating Officer of Hatton National Bank and Chairman of the ABA Policy Advocacy Committee, the first-ever webinar organized by the Asian Bankers Association (ABA) featured representatives from four ABA member banks who discussed the negative impact of the Covid 19 on their respective economies and organizations and the actions taken by them to mitigate the business disruption. They also shared the measures they are currently being set in place as part of efforts to put back the economy and the banking industry on the road to recovery.

The four webinar speakers were:

- Mr. Jonathan Alles, Managing Director and CEO of Hatton National Bank from Sri Lanka and Chairman of the ABA

- Mr. Mostafa Beheshti Rouy, Board member of Bank Pasargad from Iran, and ABA Board member

- Dr. Lin Chien-Fu, Chief Economist of CTBC Financial Holding from Taiwan

- Mr. Oliver Hoffmann, Managing Director, Head of Asia, Erste Group Bank AG, Hong Kong Branch, from Austria and ABA Board member

The presentations by the speakers were aimed to provide the participants the opportunity to explore what the new normal might look like and prepare for it, to better understand the current landscape they are operating in, and to know what they need to do to resume operations and achieve business recovery.

We are pleased to inform that the following resources are available to all participants:

(1) The complete video recording can be viewed below.

(2) The 2 Presentation PDF can be downloaded HERE.

(3) A summary of the webinar summary can be read below.

SUMMARY REPORT

Introduction

The Covid-19 pandemic is not only a health crisis of immense proportion, but it has also impacted businesses of all sizes and in all industry sectors across the Asian region and globally. Indeed, the implications are profound, and the steps taken by businesses and financial institutions will have an impact on customers, employees, and the economy at large.

The webinar – the first-ever organized by the Asian Bankers Association (ABA) – featured representatives of selected ABA member banks who shared their views on the following issues:

(1) The impact of the pandemic on their respective economies

(2) What the bankers and government authorities in their country are doing to mitigate the impact on their economy and the financial industry

(3) What measures are currently being set in place as part of efforts to put back the economy and the banking industry on the road to recovery.

(4) What their organizations are doing to assess their risk and vulnerability from both an operational and financial standpoint

(5) What actions are they taking to mitigate risks and plan for recovery scenarios and associated impacts on liquidity

(6) How are their organizations achieving business transition towards digitalization as part of its effort to adapt to the “new normal”

The webinar aimed to provide the participants the opportunity to explore what the new normal might look like and prepare for it, to better understand the current landscape they are operating in, and to know what they need to do to resume operations and achieve business recovery.

THE DISCUSSIONS

Introductory Remarks by the Moderator

The Moderator Mr. Dilshan Rodrigo, Chief Operating Officer of Hatton National Bank (HNB) and Chairman of the ABA Policy Advocacy Committee, welcomed all the participants and thanked the panelists for joining the webinar. Mr. Rodrigo noted that the panelists and the organizations they represent are strong supporters of ABA and its activities and have actively participated in many of the meetings and events organized by the ABA.

The Moderator Mr. Dilshan Rodrigo, Chief Operating Officer of Hatton National Bank (HNB) and Chairman of the ABA Policy Advocacy Committee, welcomed all the participants and thanked the panelists for joining the webinar. Mr. Rodrigo noted that the panelists and the organizations they represent are strong supporters of ABA and its activities and have actively participated in many of the meetings and events organized by the ABA.

Opening Statement by the ABA Chairman

ABA Chairman Mr. Jonathan Alles, Managing Director and CEO of HNB, pointed out that the July 29 webinar is an offshoot of the videoconference that he and Mr. Rodrigo conducted with the ABA Secretariat on June 19, 2020 to discuss how to engage ABA members during the pandemic period based on suggestions submitted by members from an earlier survey. The suggestions underscored the need to bring members together; assist them in their efforts to continue learning from each other; assess the impact of the pandemic on the Association and its members; maintain communications with and among members banks; and guide them how to move forward into the future.

Mr. Alles said that among the members’ suggestions were the following:

Mr. Alles said that among the members’ suggestions were the following:

(1) The ABA should take the initiative of conducting its own webinars in partnership with other member banks.

1.a. It was agreed that the first webinar be held on July 29th during which member banks would be invited for experience-sharing on the impact of the pandemic on their respective economies and organizations, and what measures are currently being set in place as part of efforts to put back the economy and businesses on the road to recovery.

1.b. A second webinar would be scheduled in September, focusing on a specific topic/s – to be decided later – ranging from cyber risk, compliance and further developments in digitalization, among others.

(2) It was agreed to continue the work of the ABA Policy Advocacy Committee by holding an online meeting of the Committee in November 2020. For this meeting, selected member banks would be requested to prepare some, if not all, of the six position papers on specific policy issues earlier identified by the Committee.

(3) It was further agreed to hold another online meeting of the ABA Policy Advocacy Committee during the early part of 2021 (either January or February 2021) to identify policy issues on which a new set of position papers will be prepared for presentation at the 37th ABA General Meeting and Conference to be held in August 2021.

(4) An online Planning Committee Meeting will be held in early 2021 to discuss preparations for the 37th ABA General Meeting and Conference

PRESENTATIONS BY THE PANELISTS

Dr. Lin Chien-Fu, Chief Economist, CTBC Financial Holding Co. Ltd.

In his presentation, Dr. Lin reported the following:

In his presentation, Dr. Lin reported the following:

(1) Taiwan managed the spread of the spread of the pandemic better than most countries in the region, with the number of cases kept to below 500 (with most of whom having recovered) and only 7 deaths, without having to implement a lockdown.

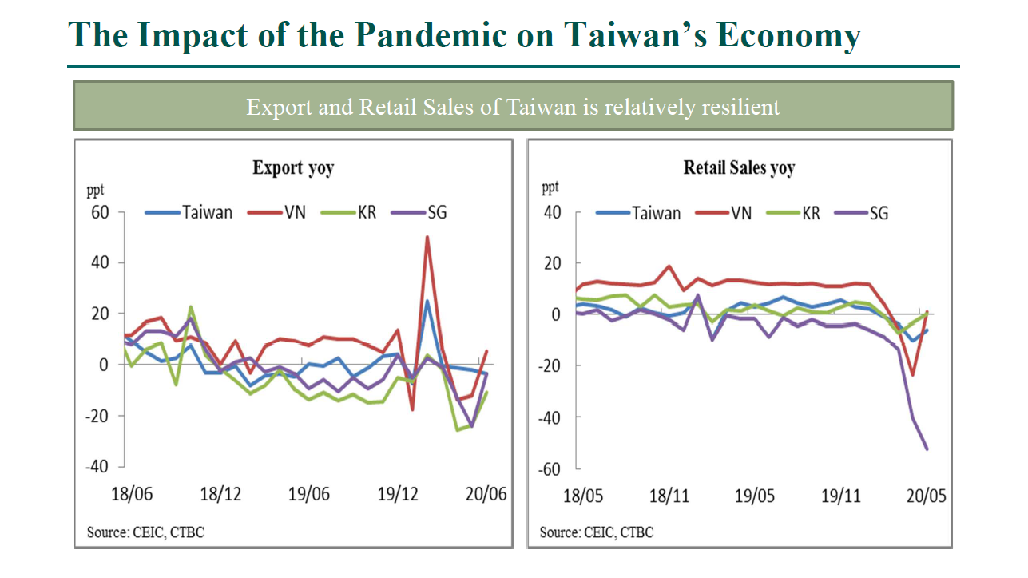

(2) The impact on the economy has not been as much as in other countries, with exports and retail sales remaining relatively resilient, and the GDP growth for 2020 expected to be positive. However, Taiwan’s economy still faces a big challenge as the pandemic has impacted international trade, affecting Taiwan’s export sector, which is an important pillar supporting the island’s economic growth.

(3) The government has set aside special budgets for subsidies for employers and unemployment benefits, for SME lending, and for subsidies for manufacturing and tourism sectors.

(4) Measures were set in place to ensure liquidity of capital market.

(5) Economic stimulus packages were implemented, including the launching of the Triple Stimulus Voucher program to boost consumption, and providing travel allowance to stimulate domestic tourism.

(6) The Central Bank imposed an interest rate cut to reduce the interest expense of households and companies, scaled up the volume of Repo to provide enough liquidity inn the financial market to smooth the operation of companies, and provided interest discounts for SMEs. Dr. Lin mentioned that CTBC Bank has promoted SME lending and applied AI to facilitate and simplify SME loan applications.

(7) In order to mitigate credit risk and attain economic recovery, the government plans to realize the credit exposure to each of the industries; monitor the impact of the pandemic and trade war on industries, measure the credit risks of each industry by checking the estimation of output growth, and promoting six strategic industries considered with great potential, including Information, Communication ,an Digitalization; 5G Industry; Biotechnology; Green Energy; National Defense Industry; and Essential Goods Industry.

Mr. Mostafa Beheshti Rouy, Member, Board of Directors, Bank Pasargad and Member, ABA Board of Directors

Mr. Beheshti Rouy reported that:

Mr. Beheshti Rouy reported that:

(1) Lockdown was implemented in March, which was the Iranian New Year holiday when local industries are usually busy with their businesses. As a result, commercial activities for industries such as transportation, hotels and restaurants slowed down to a halt.

(2) The pandemic has resulted in a 6.0 % – 6.5% contraction in the country’s GDP, tremendous job losses of about 1.5 million to 2.00 million for a 17% unemployment rate; reduction in services sector in general, and decline in non-oil exports.

(3) Among the measures undertaken by the government to mitigate the impact of the pandemic included: Financial aids to businesses and households amounting to some 4.4% of GDP; Budgetary provisions amounting to 2.0% of GDP mainly for health care; and selling of portion of government shares in some public companies in Tehran Stock Exchange to fund the financial aids.

(4) Among the measures taken by the banking sector under the central bank guidelines include: assistance to the banks’ commercial clients regarding exports, imports and letters of credit; providing financial facilities to clients; promoting digitalization; reducing banking staff presence at work.

(5) Among the measures currently being set in place as part of efforts to put the economy and the banking industry back on the road to recovery include: gradual lifting of lockdown; financial and budgetary instruments; introducing public health protocols; introducing workplace health requirements; developing guidelines for reducing disease transmission at work places; and publishing guidelines for social distancing and environment and workplace health requirements in banks

(6) To assess its risk and vulnerability from both and operational and financial standpoint, Bank Pasargad has been monitoring international and local developments; restructuring and implementing risk analysis programs; assessing health conditions and financial stability of the bank and its clients; and undertaking permanent measures such as general health and medical preparations for customers and staff, reducing physical presence of employees, digital solutions, and medical emergency solutions for infected staff

(7) To achieve business transition towards digitalization, the Bank has given more support and focuses on information technology; encouraged employees and customers to use online services; and reduced the need for physical meetings of clients and employees.

Mr. Oliver Hoffmann, Managing Directors, Head of Asia, Erste Group Bank AG, Hong Kong Branch, and Member, ABA Board of Directors

In his presentation, Mr. Hoffmann reported that:

In his presentation, Mr. Hoffmann reported that:

(1) Hong Kong is now experiencing the third wave of the Covid-19 pandemic, with tightened social distancing (no grouping of more than two persons allowed), closure of dine-in services in restaurants (except take-outs), and wearing of masks even in open spaces. However, with only 3,000 recorded cases since January 2020 and 23 deaths, Hong Kong has been doing relatively well compared to other countries. This has been due largely to a good public and private health systems of the territory.

(2) The impact on the economy has been significant, with the GDP expected to shrink by 7% – 8% in 2021, fiscal deficit expected to reach 10% of GDP, and 6% unemployment rate in June, the highest in 15 years.

(3) Services account for more than 90% of Hong Kong’s GDP. Tourism and retail, which already were weakened by the protests erupting in 2019, especially have now been hit very hard again by the virus.

(4) The government will spend in total US$47.5 billion to fight the crisis. The budget for this year already included a US$15.5 billion spending package and on top of that there are now a Virus Support Package for US$ 18 billion, an Employment Support Scheme for US$ 10 billion, and an Anti-Epidemic Fund for U$4 billion.

(5) The Hong Kong Monetary Authority (HKMA) has been very supportive of the banks, releasing US$ 130 billion of lending capacity through various measures, such as lowering the counter-cyclical capital buffer, cutting the regulatory reserve requirement in half, and providing US$ liquidity through a new US$ 10 billion facility.

(6) For corporate customers, a Principal Payment Holiday Scheme was set in place, loan repayment periods were extended, and trade finance loans were converted into overdraft facilities. Each adult Hong Kong resident received a HK$ 10,000 (US$1,300) cash handout from the government.

(7) As far as bank operations are concerned, all banks had been updating their Business Continuity Plans already during the protest period in 2019 upon the request of the HKMA and now made further additions to address the virus threat. Almost all banks also opted for split teams and allowed as many employees as possible to work from home.

(8) In a crisis situation, liquidity is of utmost importance. Hong Kong banks should have no problem in this regard. The banks are very healthy – and the HKMA has very deep pockets. A longer-term risk factor is the capital position of banks threatened by rising non-performing loan levels. Again, Hong Kong banks should not have a problem in this regard as they have sufficient buffers and reserves.

(9) Looking ahead, Hong Kong’s GDP is expected to grow again 6% in 2021, of course subject to the virus being brought under control, the opening of borders, and China returning to growth. China is the single most important factor for returning the Hong Kong economy on to a growth path. Once this process starts, Hong Kong banks will be able to employ their still very strong lending capacity.

(10) The pandemic definitely served as a catalyst for change and action in the banking sector, further speeding up digitalization and making banks think about how to structure work arrangements in the future, including video conferencing and working from home.

Mr. Jonathan Alles, Managing Director and CEO, Hatton National Bank and Chairman, Asian Bankers Association

Highlights of Mr. Alles’ presentation included the following:

Highlights of Mr. Alles’ presentation included the following:

(1) The government (mainly through the Ministry of Health and the Army) was able to contain virus spread through positive and pro-active preventive steps, including imposing regular curfews, days-long lockdown even on weekends to enforce social distancing, disallowing congregation of large crowds, and putting in place thermometers and sanitizers at banks and most other places.

(2) The government, in coordination with the central bank, banks and the private sector, took pro-active and immediate steps to support industries, especially those impacted by the pandemic. The provision of banking services was ensured, along with transport services.

(3) The government, with the central bank, came up with relief schemes, including a 50-billion-rupee relief scheme for working capital requirements. Extensions on credit card loan for four months were granted, depending on criteria.

(4) Moratorium was granted to the hospitality industry, particularly tourism on which the Sri Lankan economy is heavily dependent, as well as to the export sector.

(5) Credit guarantee schemes were set in place to support working capital requirements and to enable banks to leverage their portfolios to get more funds at 1%.

(6) The construction industry was allowed to issue commercial paper to create liquidity.

(7) Liquidity has not been an issue as capital is provided at concessional rate and to encourage lending. Demand for credit is now growing after a drastic drop compared to previous years. The Sri Lankan economy is currently in full gear apart from industries that are most affected.

(8) The government has ensured that not all need to go to work (especially the elderly and those who are ill) and has encouraged working-from-home arrangements instead.

(9) A silver lining of COVID is the increase in digitalization possibilities for banks and businesses. It has made possible cashless and checkless payments and other services, particularly in such essential industries such as food, beverage and pharmaceuticals.

(10) The greater use of technology has also enabled banks to make further inroads in functionality and value, improvements in secure and collaborative workspaces to enable effective WFH, and tracking productivity as more employees work remotely, thereby freeing up office space.

(11) The central bank has been taking pro-active steps in this regard.

QUESTIONS & ANSWERS

During the Q&A session, Moderator Mr. Rodrigo requested the panelists to respond to some of the questions posted by the webinar participants. These included the following:

Question: The economic impact of COVID-19 pandemic has been considerable. More marginalized sectors would face more hardships, more inequality, with people getting more desperate. These may lead some people to exploit the weaknesses in the systems and control of banks, thereby resulting in challenges for banks (e.g., cyber risks, cyber fraud and other forms of external frauds). What kind of actions have your institutions taken to address these risks?

Mr. Hoffmann: Cyber risks had been an issue already before the onset of the pandemic and the HKMA already had required all banks in Hong Kong to pay high attention to this in previous years. We have not seen a major increase in really serious cyber attacks on our systems but there is an increase in Covid 19-related spam and, with more employees working from home and outside of the bank’s ‘safe IT environment’, the underlying risk certainly has increased. We addressed this through increased employee awareness training.

Mr. Beheshti Rouy: The Bank for International Settlements (BIS) have issued recommendations and guidelines on how to mitigate the impact of the pandemic. Among others, the BIS emphasized the need to raise awareness of the risks resulting from the pandemic and other related risks through public announcements or issuance of public statements, the need for information sharing on COVID related threats, and the need to achieve cyber resilience. Banks should try to put these issues on their agenda.

Mr. Rodrigo: Hatton National Bank (HNB) has been providing assistance to those affected by the pandemic, particularly the small businesses, through its microfinance programs. HNB, along with many other banks in Sri Lanka, has a significant exposure in the microfinance sector. These would include the provision of re-financing schemes (with the support of government), working capital financing schemes, and supply chain linkages

Dr. Lin: To help stimulate economic recovery, the Taiwanese government has launched the Triple Subsidy Voucher Program. Under this Program, individuals will pay NT1,000 to buy paper vouchers or digital coupons worth NT$3,000, which they can then use to buy items from small shops, night markets, etc.

Question: Banks have implemented unconventional measures during the crisis. How do you ensure that these practices are sustained post-crisis and we don’t waste the crisis?

Mr. Hoffmann: Certain change is here to stay, the more the longer the crisis situation persists. However, not all crisis measures can be sustained in the long run and I think we will go back over time to established and proven procedures, at least partially. Certain banking activities require staff to be in a controlled and safe office environment, mainly for systems, compliance, and regulatory reasons. Another important aspect is human interaction and team work, you have to really bring together people for this in person.

Mr. Rodrigo: One challenge in remote working is how to measure productivity and efficiency, especially in work assignments or roles where tangible deliverables cannot be identified (unlike, say, merchandising in apparel industry). There is a need to strengthen technology in this area.

Question: With the acceleration of digital transformation efforts, banks have to go head to head with Fintech companies. How is this panning out?

Dr. Beheshti Rouy; The Covid-19 pandemic has been a driving force in pushing through with the digitalization efforts that we started pre-Covid to meet the challenge and competition posed by the emerging Fintech companies. For instance, the Bank launched two projects using Artificial Intelligence (AI) aimed at: (a) enhancing our customer retention model, and (b) allowing our relationship managers to better understand and anticipate customers’ future needs based on their spending habits, as well as to gain new customers. With the onset of the pandemic, the Bank is now giving more time and energy to these projects.

Question: How important is the Business Continuity Plan (BCP) to your organizations, and how do you go about implementing this

Mr. Hoffmann: Many people did not take the BCP very seriously before the crisis. The events now have shown that it is very important to have this document in place and be familiar with it. As I mentioned before, banks in Hong Kong had to refer to their BCP’s or even put them into action already during the protest period in 2019. The main concern in the past was a breakdown of IT systems or losing access to the office premises, but with the health crisis we now had to update our plan for a situation where a large part of our staff may get infected and may have to go into quarantine. We addressed this by splitting our team, making sure key personnel for key functions were put into each shift and prohibiting any direct personal contact between the shifts.

Dr. Lin: Under the new normal, we can expect an increase in the level of national debt and hence, an increase in taxes as well, as government spending is expected to rise due to pandemic-related subsidies. There us also a need for measures aimed at helping young people cope with the impact of the health crisis.

Dr. Beheshti Rouy: BCP is very important and plays a major role. It is therefore necessary to invest in strengthening BCP, particularly in having contingency plans (B/C) to ensure the systems will work and to accommodate additional functionalities under critical circumstances. Bank Pasargad has invested a lot to ensure continuity and availability of its services at all times. Doing so is costly but needed.

Question: How important is digitalization under Covid-19 situation?

The panelists agreed on the greater importance of digitalization under the pandemic environment, citing the need to: (a) promote the use of digital wallet for greater convenience of customers; (b) build infrastructure around online shopping and other internet payment gateways; (c) establish not only online payment facilities, but also offline payment facilities in preparation for the future when the Covid situation improves and customers demand for more face-to-face transactions; (d) consider cultural factors in pursuing digitalization; and (e) establish leadership to instill community discipline and decisiveness in communication

Question: What is one learning as to what banks should be doing to prepare for a crisis?

Mr. Hoffmann: One key learning was that our staff were really willing to take responsibility and make a strong personal commitment in a crisis situation. People stepped forward and helped out across teams, so cross-training in job responsibilities does pay off. The crisis really brought out the entrepreneurial spirit in many of our employees.

Mr. Beheshti Rouy: People have general shown positive reaction to the crisis, demonstrating their sense of responsibility. Organizations have recognized the need for soundness of policies towards digital transformation as a means of achieving innovation and improving services.

Dr. Lin: The private sector has recognized the need to help government in assisting people to survive during the pandemic, as well as the application of AI in improving their business operations. The pandemic has also shown that it is not easy to do economic forecasting, particularly an accurate one.

Mr. Rodrigo: In periods of uncertainty, there is a need to think and forecast in the form of scenarios – across the board, economic trends, impairment, profitability, liquidity, and other areas. Scenario Planning as a discipline will assist in broader understanding of issues and in coming up with well thought-out strategies to cope in an uncertain future.

Leave a Reply