Asian Venture Philanthropy Network (AVPN) and Oliver Wyman, with the support of the Asia Pacific Risk Center (APRC), have collaborated on the report Driving ESG Investing in Asia – The imperative for growth, to inform investors in Asia about their role in channeling capital to improve social and environmental wellbeing along with achieving desired financial performance. This was executed as part of the Oliver Wyman Social Impact project initiative.

Asian Venture Philanthropy Network (AVPN) and Oliver Wyman, with the support of the Asia Pacific Risk Center (APRC), have collaborated on the report Driving ESG Investing in Asia – The imperative for growth, to inform investors in Asia about their role in channeling capital to improve social and environmental wellbeing along with achieving desired financial performance. This was executed as part of the Oliver Wyman Social Impact project initiative.

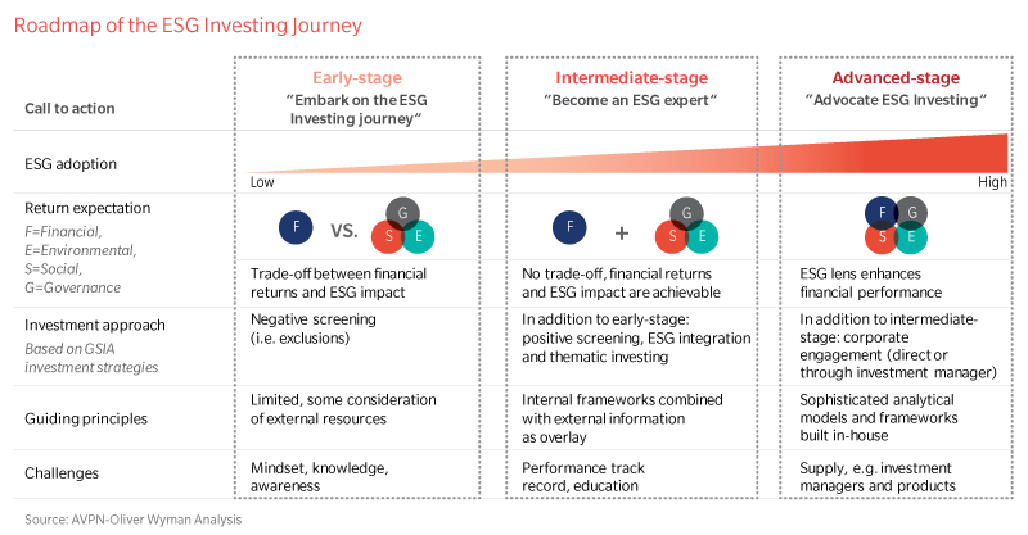

The report highlights the existing ESG Investing landscape in Asia and illustrates key observations and common challenges faced by early adopters. It also outlines six practical steps investors can take to initiate their journey into ESG Investing, and provides key learnings and recommendations for those aiming to embark on similar journeys.

The growing allure of ESG investing

Today, some of the world’s biggest asset managers boast large and successful ESG funds. ESG Investing has seen a surge in volume across the world, with $23 trillion of ESG assets under management (AUM) being deployed as of 2016.

However, the uptake of ESG investing in Asia appears slower than other regions, attributed to reasons, such as challenges unique to Asia (for example a combination of limited knowledge and skill resource gap, and the lack of consequences for inactions or collective efforts).

This reports aims to better understand these challenges and highlight opportunities and practical approaches for investors in Asia to embark on their ESG Investing journey.

Driving ESG investing in Asia

Driving ESG investing in Asia

Related themes:

Leave a Reply