Recent technological developments have profoundly reshaped the business functions inherent in finance. Finance as we know it today looks set to be disrupted by the combined digital forces of Big Data, robotics and artificial intelligence. The processes, teams and systems concerned will have to evolve if they are to accommodate new business models and new client demands.

Recent technological developments have profoundly reshaped the business functions inherent in finance. Finance as we know it today looks set to be disrupted by the combined digital forces of Big Data, robotics and artificial intelligence. The processes, teams and systems concerned will have to evolve if they are to accommodate new business models and new client demands.

A finance function that no longer spearheads companies’ digitalization…

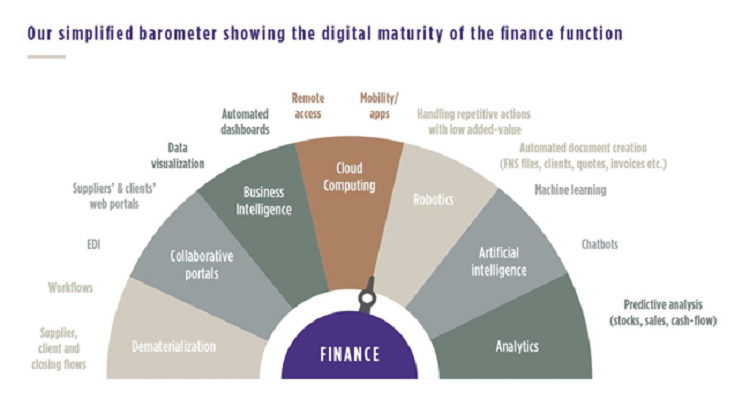

The finance function is no longer the leader for new digital uses, despite having swiftly adopted early technological initiatives and having been quick to benefit from the first “digital waves”:

– All back office functions have benefited from the implementation of ERP (Enterprise Resource Planning) systems and dematerialization;

– Management control functions also got on board with Business Intelligence tools at a very early stage.

The finance function has yet to fully tap into the potential afforded by new technologies. Priority has been given to client-centric functions (communications, advertising, marketing, sales, client services), while the processes that tie in with the support functions have been less affected.

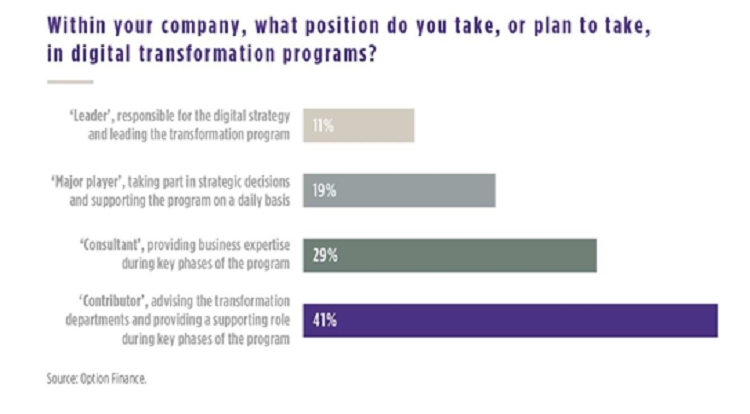

The upshot today is that Chief Administrative and Financial Officers tend to consider themselves as contributing to, and being consulted on, digital transformation programs, rather than being major players or leaders in the digital transformation.

…while being fully aware of the digital opportunities

While 86% of stakeholders polled consider digitalization as a major challenge for the finance function, its impact is still considered limited. Only half of the those consulted believe that its impact is significant. However, players in finance departments estimate automation potential for their sector at nearly 30%.

2019 promises to be a year of acceleration insofar as 50% of players would like to get these optimizations underway before 2020.

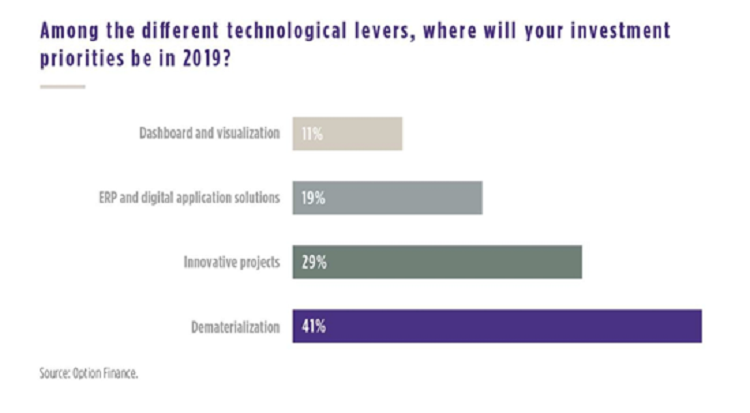

For large companies, dematerialization represents the main equipment project in terms of digital tools, closely followed by innovative projects, in particular collaborative solutions with external partners, which are equally perceived to be of high importance.

The finance function therefore has significant and unexploited potential for digitalization. The best-placed finance departments are beginning to integrate the innovations provided by robotization, AI and Big Data.

Nevertheless, the integration of these new innovations still only accounts for a small share of the overall budget of finance departments, at 16%*. Integration generally takes place through the implementation of POC (Proof Of Concept) and tests. There are few initiatives for the definition of an overall strategy for the digitalization of the finance function. For example, today’s Robotic Process Automation (RPA) tools are mature, their capacity and functionality known, but financial managers still do not trust these products and prefer to test them before embarking on major projects.

Financial processes with differing levels of maturity, but good prospects

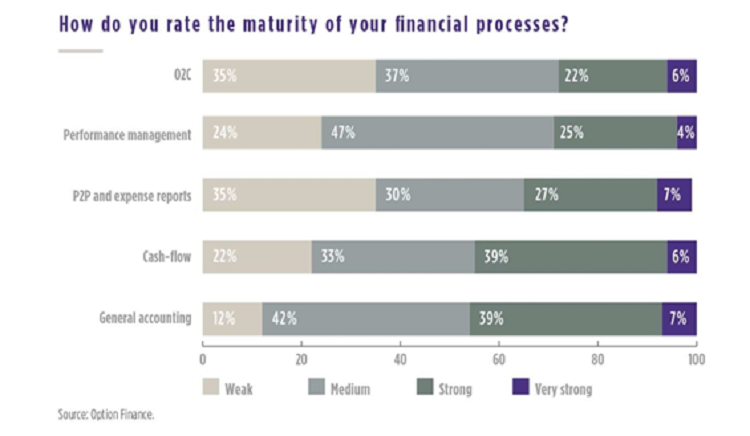

Chief Administrative and Financial Officers consider that general accounting and cashflow are currently the most digitalized processes.

While general accounting and procure to pay were the strongest investments last year, 42% and 39% respectively, they will still be the subject of most of the transformation efforts in 2019, at 38% and 31% respectively. However, new efforts are expected in terms of performance management, which should receive 27% of investments, compared to less than 15% in 2018.

Reinventing accounting with robotization

While the profession’s survival is not in doubt, it will have to reinvent itself in the coming years and move towards tasks with higher added value, such as analysis and auditing.

ERP as we know it today was born in the 1980s and 1990s. Finance, being highly standardized and administrative, was one of the first embedded functions. The following decade broke down barriers and also made ERP more flexible, as it began hosting its services on the cloud, allowing access via smartphones or tablets, offering specific functionalities to certain markets, and so on.

This natural evolution has gone hand in hand with the robotization of the accounting function, gradually automating the last remaining manual tasks. This means that the often lengthy, complex and poorly equipped closing process is now being digitalized in order to save precious time in the publication of financial information.

Client accounting… geared towards clients

The digitalization of the order to cash process will make it possible to focus on the challenges of reducing payment delays, optimizing working capital and, above all, improving client service.

The finance function has embarked on the optimization of the order to cash process by focusing on investments rather than invoicing and payment recovery. This first step was illustrated by the implementation of shared service centers for these two functions, with the adoption of invoice dematerialization solutions and the automation of validation circuits.

However, these projects have highlighted certain pitfalls, particularly with regard to the reliability of client data and contracts. The finance function has therefore collaborated with other departments (sales, logistics) to set up shared repositories using fully collaborative and integrated tools, from prospecting to conflict management.

Today, the challenges of process optimization are located:

– Upstream: facilitating client experience and limiting disputes;

– Downstream: facilitating payment recovery and monitoring payment terms, as well as optimizing working capital requirements.

The continuation of digitalization projects will depend on the ability of companies to structure their processes around a clear governance system that brings together all the business functions concerned in the client cycle.

Making accounts payable more strategic and proactive

Predictive analysis of expenses will enable purchasing and accounts payable to be an integral part of companies’ strategy. The digitalization of the procure to pay process will allow buyers and finance to free themselves from low value-added tasks, enrich their knowledge of suppliers, and streamline expenses. They will then be able to focus on their direct contribution to their company’s overall performance.

Following the digitalization of sales and client-oriented functions (e.g. marketing), the purchasing and procurement function has been making the same shift in recent years. From now on, purchasing and procurement will be much more open, both externally concerning their prospects and suppliers, thus making their relationships more fluid, but also internally, instilling a cost-control culture throughout companies.

Digital technology is still mainly perceived as being operational and transactional rather than a strategic and relational lever in procurement. Organizations are still in the “first age” of digital technology, and there is therefore enormous potential for development.

The digitalization of the finance function is now directed towards the programming of purchasing, sourcing and drafting of calls for bids, contract management, procurement and invoicing of suppliers.

In the short term, these tools will make it possible to digitalize decision-making and purchasing strategies (mapping and supplier evaluation, expense analysis), positioning the buyer and procurement at the centre of an ecosystem of suppliers, prescribers and legal services.

Predictive tools: a lever for optimizing cashflows

Cashflow forecasting is one of the top priorities for treasurers and CFOs, who are simultaneously addressing cybersecurity and compliance issues.

The cashflow function has gradually become a facilitator of multiple processes within companies. The traditional model of management based on technical skills and centralization is no longer effective. Treasurers use cash management systems provided by ERP vendors (Oracle, SAP, etc.) or pure cashflow players (Sage, Sungard, IT2, Kyriba, Wall Street, Reuters, etc.).

Today, the economic context is pushing companies to demand increasingly accurate and sometimes real-time information. Cashflow processes must become ever more efficient through automation, Big Data and data visualization. Cashflow forecasting is developed through predictive models, with the goal of obtaining more accurate estimates. By providing transparency through transaction recording chains that include all the actors in the process, the blockchain can meet the challenges of traceability and security:

– Optimization of cash management through cash pooling and automation of flow processing

– Reliability of flow forecasting

– Security of data transfer

– Data compliance

When will the end of “excellence” and the transition to 100% analysis come?

Management control is evolving towards an ever more strategic approach through increased collaboration with operational managers, yet it is still a business function involving a significant amount of production.

The challengers of the EPM (Enterprise Performance Management) and Business Intelligence tools were the major players in the latest technological breakthrough in performance management. These solutions offer more agility than traditional leaders with cloud-based, interoperable solutions and simplified administration that have resulted in productivity gains.

Today, the appropriation of the new technologies offered by these tools is underway with an emphasis on collaboration, mobility and real-time data exploitation. Nevertheless, the various competitors must still prove themselves in their treatment of high volumes.

The next technological breakthrough should allow the generalization of Big Data, AI and robotics in data production and analysis. Big Data is already well integrated into solutions that offer mature predictive models shared between the business and finance functions. While AI and robotics are still at the experimental stage where they are being checked for reliability.

The original article was published in the EFMA website.

Leave a Reply