Taipei – The year 2018 saw the Asian Bankers Association (ABA) undertaking activities aimed at further enhancing the value of the Association to its members and the Asian banking sector as a whole. Conceptualized and implemented with the valuable guidance and support of ABA members, the activities and projects of the Association in 2018 are summarized in this Year-in-Review report.

I. Preparations for the 35th ABA General Meeting & Conference

A. Planning Committee Meeting

(1) The 2018 ABA Planning Committee Meeting was held on March 8, 2018 at Kurumba Resort in Maldives, with Bank of Maldives led by its Managing Director and CEO as the host organization. Presided by ABA Chairman Mr. Daniel Wu, the meeting was attended by 18 representatives of 7 banks from 6 countries, including Austria, Iran, India, Maldives, Republic of China (Taiwan), and Vietnam.

(2) The Planning Committee focused its discussions on:

(2.a) Preparations for the 35th ABA General Meeting and Conference, with the deliberations focusing on the final dates and venue, themes and topics for the seminar, line-up of possible speakers, and suggested program, among others.

(2.b) The progress of the various activities and projects outlined under the ABA 2017 Work Program and suggestions for their effective implementation.

(2.c) The Work Program for 2018 of the ABA Policy Advocacy Committee.

(3) Among others, the Planning Committee agreed that:

(3.a) The 35th ABA General Meeting and Conference would be held on November 15-16, 2018 at Kurumba Resort in Maldives;

(3.b) The Committee decided on the following theme and topics for the 2018 Conference:

Theme: Banking in Asia: The Next Frontier

Session One Topic: Technology in Banking: The Next Wave

Session Two Topic: Risk Management Imperatives in the New World Order

Session Three Topic: Sustainable Banking: Challenges and Opportunities

Ocular Inspection of the Conference Venue

(4) Following the meeting, members of the ABA Planning Committee led by ABA Chairman Mr. Daniel Wu and Bank of Maldives officers led by Managing Director and CEO Mr. Andrew Healy, conducted an ocular inspection of the Conference facilities of Kurumba Resort to check on the suitability of the meeting rooms and the social functions venues. They later met to discuss the necessary preparations to be made for the Conference (e.g., the promotional brochure, registration procedure, hotel booking, etc.)

Meeting with the Central Governor and the Finance Minister of Maldives

(5) Members of the ABA Planning Committee led by ABA Chairman Mr. Daniel Wu were accompanied by Bank of Maldives Managing Director and CEO Mr. Andrew Healy and other Bank officers in meeting with Mr. Ahmed Naseer, Governor of Maldives Monetary Authority (MMA), followed by a meeting with Minister of Finance and Treasury Mr. Ahmed Munawar, on the afternoon of March 9 at the premises of MMA.

(5) Members of the ABA Planning Committee led by ABA Chairman Mr. Daniel Wu were accompanied by Bank of Maldives Managing Director and CEO Mr. Andrew Healy and other Bank officers in meeting with Mr. Ahmed Naseer, Governor of Maldives Monetary Authority (MMA), followed by a meeting with Minister of Finance and Treasury Mr. Ahmed Munawar, on the afternoon of March 9 at the premises of MMA.

(6) Mr. Wu extended his invitation to Governor Naseer and Minister Munawar to join the35th ABA General Meeting and Conference in November 2018, which would be hosted by Bank of Maldives. He pointed out that the November Conference is significant as it will be the first time that ABA will be holding its annual Conference in Maldives. He informed Governor Naseer and Minister Munawar that a Planning Committee Meeting took place earlier in the morning at Kurumba Resort discuss preparations for the Conference.

(7) Governor Naseer conveyed his warm welcome to the ABA delegates, all of whom were first-time visitors to Maldives. He also expressed his strong support of the 35th ABA General Meeting and Conference to be held in Maldives in November 2018. He shared information and his valuable insights on the latest economic and banking sector developments in Maldives, allowing the ABA delegates to get a better understanding on the country’s financial market and its relevant monetary policies.

(8) Minister Munawar expressed his hopes that a big contingent of foreign bankers will be able to join the event and take advantage of their presence in Maldives to know more about the country’s economy and banking sector and network with local bankers. Mr. Munawar also briefed the visiting ABA delegation about the current economic situation in Maldives, as well as the recent trends and developments in the country’s financial sector. He also shared his thoughts on the economic prospects of the country and what may lie ahead for the banking sector.

Visit to the Bank of Maldives Headquarters

(9) Members of the ABA Planning Committee led by ABA Chairman Mr. Daniel Wu visited the headquarters of Bank of Maldives following the Committee’s meeting on March 8. The visiting delegation was given a briefing by Bank of Maldives Managing Director and CEO Mr. Andrew Healy on the history and operations of the Bank, its performance, and its future plans.

B. Coordination with Host Bank

(10) Subsequent to the Planning Committee Meeting, the ABA Secretariat coordinated with Bank of Maldives – through a series of regular teleconferences – on preparations for the 35th ABA General Meeting and Conference. Discussions focused on the tentative program, the contents of the brochure, and logistical arrangements for the meeting (e.g., accommodation, meeting venues), among others. A line-up of possible speakers was identified and invited, and subsequent follow-ups were made.

(10) Subsequent to the Planning Committee Meeting, the ABA Secretariat coordinated with Bank of Maldives – through a series of regular teleconferences – on preparations for the 35th ABA General Meeting and Conference. Discussions focused on the tentative program, the contents of the brochure, and logistical arrangements for the meeting (e.g., accommodation, meeting venues), among others. A line-up of possible speakers was identified and invited, and subsequent follow-ups were made.

C. Request for Suggestions on Activities for the 2018-2020 Work Program

(11) One of the agenda items to be taken up at the upcoming 35th ABA General Meeting and Conference in Maldives is the formulation of a Framework for the 2018-2020 ABA Work Program for implementation during the two-year term of the new members of the ABA Board of Directors to be elected during the Maldives Conference.

(12) For this purpose, ABA members were requested to submit their suggestions on activities that the Association should undertake in the next two years. These activities should, as much as possible, benefit all members, further promote the growth and development of the Association, and help ABA attain its primary objectives. All responses will be incorporated into a draft Work Program for consideration during the 56th ABA Board of Directors Meeting to be held on the afternoon of November 16, 2018.

D. Request for Nominations for Members of the 2018-2020 ABA Board of Directors

(13) One of the activities at the 35th ABA General Meeting and Conference in Maldives was the election of the members of the ABA Board of Directors and officers to serve for the term 2018-2020. Towards this end, ABA members were requested to submit their nominations for the incoming Board.

(14) To ensure a geographical spread of representation in the Board, members were asked to nominate at least one domestic member-bank from each Asian country, and a total of not more than 5 multinational banks with regional presence in Asia. In this regard, only regular members who were up-to-date with their membership fees may vote or be voted upon.

(15) Voting was by secret ballot. The counting of votes and announcement of results were to be completed on November 15 in Maldives under the supervision of the Committee on Elections.

II. POLICY ADVOCACY

A. Approval of the Policy Advocacy Committee Work Program for 2018

(16) The ABA Policy Advocacy Committee held its first meeting for 2018 on March 8 in Maldives, in conjunction with the Planning Committee Meeting. Chaired by Ms. Prudence Lin, Senior Vice president from CTBC Bank, the meeting approved the Committee’s Work Program for 2018.

(17) The objectives of the 2018 Work Program of the Policy Advocacy Committee included the following:

- Promoting Cooperation in Cyber Security Management

- Promoting cooperation in achieving the rapid adoption of new financial technologies and attaining greater understanding of its implications for, and potential impact on, the financial industry

- Promoting cooperation in Islamic Banking

- Promoting greater understanding and sharing of the implementation results in the area of KYC/AML/CFT compliance

- Encouraging member banks to promote institutional linkages and partnerships to make micro, small and medium enterprises commercially bankable

B. Dissemination of ABA Position Papers

B. Dissemination of ABA Position Papers

(18) The ABA circulated to all members and published in the ABA Newsletter the following papers finalized by the ABA Policy Advocacy Committee at its meeting in November 2017 in Mumbai:

(18.a) A paper sharing the experience and practice of Erste Group Bank in promoting financial literacy among its customers in Austria

(18.b) A paper sharing the experience and practice of State Bank of India in promoting financial inclusion in India through SME lending

C. Survey on ABA Informal Workout Guidelines

(19) The ABA Secretariat conducted a survey aimed at determining member banks’ interest to know more about the documents entitled “ABA Informal Workout Guidelines-Promoting Corporate Restructuring in Asia” and the “Model Agreement to Promote Company Restructuring: A Model Adaptable for Use Regionally, by a Country, or for a Particular Debtor”

(19) The ABA Secretariat conducted a survey aimed at determining member banks’ interest to know more about the documents entitled “ABA Informal Workout Guidelines-Promoting Corporate Restructuring in Asia” and the “Model Agreement to Promote Company Restructuring: A Model Adaptable for Use Regionally, by a Country, or for a Particular Debtor”

(20) These two documents were developed and adapted by the ABA – with assistance from the Asian Development Bank – in 2005 and subsequently revised in 2013 following inputs from APEC Business Advisory Council (ABAC) and the International Insolvency Institute (III). They contain principles which aim to guide financial creditors on how they should deal with debtors in difficulties in circumstances where the debtor is dealing with multiple financial creditors as creditors.

D. ABA Invited to Support Project on “South/Southeast Asian Business Society Models”

(21) The ABA was invited by Mr. Chandula Abeywickrema, Chairman of CSR Lanka and ABA Special Advisor on Financial Inclusion to support a project with the Durham University UK on “South/Southeast Asian Business Society Models” which will focus on SMEs.

(22) Funded by the Economic and Social Research Council (ESRC) UK as part of Britain’s Official Development Assistance, the 30-day project covered Sri Lanka, Bangladesh, Nepal, Indonesia, Malaysia, Cambodia, and Myanmar. It was conducted primarily by CSR Lanka, which is an initiative piloted and managed collectively by a group of private sector companies in Sri Lanka with the aim of providing strategic guidance and necessary resources to bridge the gap between ad hoc CSR projects and creating sustainable value.

(23) Mr. Abeywickrema requested the ABA to endorse the project and to facilitate – within its organizational mandate – the project in the countries covered. By endorsing the project, the ABA is given the opportunity to participate in workshops/conferences and knowledge sharing events in the South/Southeast Asian region to be organized by the Durham University Research Office and use the research findings. According to Mr. Abeywickrema, there was no financial obligation on the part of the ABA, as the cost of project activities would be borne by the Durham Research Office and ESRC and that costs of the participation of a designated ABA representative in workshops/conferences would be covered by the project.

III. TRAINING PROGRAMS

A. Short-term Visiting Program

(24) Since the 34th ABA General Meeting and Conference held in November last year in Mumbai, the ABA has been coordinating with a number of member banks on the possibility of hosting short -term visiting programs for members in 2018

(25) The primary objective of ABA’s short-term visiting programs is to provide member banks – especially those from developing countries – the opportunity to study and undergo training on specific aspects of the operations and facilities of the more advanced host banks. There is no participation fee for attending the short-term visiting program. However, participants shall cover their airfare and hotel accommodation.

(26) The member banks who agreed to host short-term visiting programs for members in 2018 included the following:

Hatton National Bank (HNB) – The HNB agreed to organize a visiting program for ABA members on May 17-18, 2018 in Colombo, Sri Lanka. The two-day program aimed to cover topics such as the Evolution of Risk Management at HNB; Operational Excellence; Business Process Re-engineering; and Driving the Digital Proposition. Arrangements were also made for the participants to visit the Central Bank of Sri Lanka, the Credit Information Bureau of Sri Lanka, and the National Cheque Clearing House in Sri Lanka. However, the short-term visiting program was canceled/postponed as the number of registered participants fell below the minimum required by Hatton National Bank.

Hatton National Bank (HNB) – The HNB agreed to organize a visiting program for ABA members on May 17-18, 2018 in Colombo, Sri Lanka. The two-day program aimed to cover topics such as the Evolution of Risk Management at HNB; Operational Excellence; Business Process Re-engineering; and Driving the Digital Proposition. Arrangements were also made for the participants to visit the Central Bank of Sri Lanka, the Credit Information Bureau of Sri Lanka, and the National Cheque Clearing House in Sri Lanka. However, the short-term visiting program was canceled/postponed as the number of registered participants fell below the minimum required by Hatton National Bank.

Rizal Commercial Banking Corporation (RCBC) – RCBC agreed to host a Microfinance workshop on June 4-5, 2018 in Manila – the third one after similar workshops were held in January 2013 and in June 2015, both also in Manila. The primary objective was to provide ABA member banks, particularly those who are interested to engage in microfinance as a business initiative, the opportunity to learn from the experience, best practices, and expertise of RCBC and its microfinance arm Rizal Microbank. Unfortunately, the workshop was re-scheduled to a later date as the number of participants did not reach the minimum requirement of RCBC.

Rizal Commercial Banking Corporation (RCBC) – RCBC agreed to host a Microfinance workshop on June 4-5, 2018 in Manila – the third one after similar workshops were held in January 2013 and in June 2015, both also in Manila. The primary objective was to provide ABA member banks, particularly those who are interested to engage in microfinance as a business initiative, the opportunity to learn from the experience, best practices, and expertise of RCBC and its microfinance arm Rizal Microbank. Unfortunately, the workshop was re-scheduled to a later date as the number of participants did not reach the minimum requirement of RCBC.

State Bank of India (SBI) – The ABA Secretariat corresponded with the State Bank of India on the possibility of hosting – for the second time – a short-term visiting program for ABA member banks in other Asian countries in July. To be held at the State Bank Staff College in Hyderabad tentatively, the two-day program aimed to feature speakers from SBI who would share their expertise and the bank’s experience in various banking operations. However, SBI later suggested holding the workshop at a later date and in the Bank’s Mumbai headquarters (instead of Hyderabad).

State Bank of India (SBI) – The ABA Secretariat corresponded with the State Bank of India on the possibility of hosting – for the second time – a short-term visiting program for ABA member banks in other Asian countries in July. To be held at the State Bank Staff College in Hyderabad tentatively, the two-day program aimed to feature speakers from SBI who would share their expertise and the bank’s experience in various banking operations. However, SBI later suggested holding the workshop at a later date and in the Bank’s Mumbai headquarters (instead of Hyderabad).

Sumitomo Mitsui Banking Corp. – The Secretariat coordinated with the Sumitomo Mitsui Banking Corp. (SMBC) on the possibility of once again hosting another short-term visiting program in Tokyo. The proposed two-day program will feature speakers who will share SMBC’s experience and practice in international banking, global institutional banking, global transactional banking, and project financing. Members will be advised as soon as arrangements are finalized.

Sumitomo Mitsui Banking Corp. – The Secretariat coordinated with the Sumitomo Mitsui Banking Corp. (SMBC) on the possibility of once again hosting another short-term visiting program in Tokyo. The proposed two-day program will feature speakers who will share SMBC’s experience and practice in international banking, global institutional banking, global transactional banking, and project financing. Members will be advised as soon as arrangements are finalized.

Malayan Banking Berhad – Maybank hosted another shortterm visiting programs for ABA members on October 18-19, 2018 in Kuala Lumpur. Attended by 26 representatives from six banks in five Asian countries, Maybank’s program covered: (1) the Bank’s International’s Journey, Mission & Aspirations; (2) Compliance; (3) Banking Hall Tour; (4) Risk; (5) Maybank Group Wealth Management Business; and (6) Transaction banking/Global Markets, among others. The October 2018 Program followed the highly successful and well received Maybank’s programs held in 2014, 2015 and 2017.

Malayan Banking Berhad – Maybank hosted another shortterm visiting programs for ABA members on October 18-19, 2018 in Kuala Lumpur. Attended by 26 representatives from six banks in five Asian countries, Maybank’s program covered: (1) the Bank’s International’s Journey, Mission & Aspirations; (2) Compliance; (3) Banking Hall Tour; (4) Risk; (5) Maybank Group Wealth Management Business; and (6) Transaction banking/Global Markets, among others. The October 2018 Program followed the highly successful and well received Maybank’s programs held in 2014, 2015 and 2017.

B. ABA – Oliver Wyman Webinars

February Webinar

(27) The ABA invited Chief Risk Officers (CROs) and managers of member and non-member banks to participate in a webinar on “Implications for organization, skills and role of the Chief Risk Officers given technological developments” which the ABA conducted in cooperation with Oliver Wyman on February 27, 2018.

(28) The 50-minute webinar – the first ever conducted by ABA – offered a highly-strategic overview of the skills required for C-Suite Risk experts to thrive in today’s complex and volatile world, as well as keenly focusing on the implications for organizations given the plethora of technological developments impacting business globally.

(29) The webinar speakers were Mr. Chu Cheng, a Partner at Oliver Wyman, Singapore, and Ms. Shikha Johri, a Principal at Oliver Wyman, Singapore; both with extensive experience on the subject. Participants – which totaled 94 from 45 banks from 17 countries – received copies of the speakers’ presentations and took a take-home test after the webinar’s conclusion. Participants who emailed back their answers to the take-home test received Certificates of Participation.

March Webinar

(30) The ABA and Oliver Wyman held a well-received second webinar on “Overview of Advanced Analytics and Data in Risk Applications” and “Advanced Analysis and Data in Credit Applications” on March 20, 2018, with 88 officers from 6 countries participating. The one-hour on-line course provided participants the opportunity to delve deeper into the world of advanced analytics and gain an overview of applications of advanced analytics in risk management, illustrated with practical examples. Specifically, they were able to draw insights from the advanced analysis of data in credit applications.

(31) Leading the discussions were Mr. Mikko Lehtonen, Engagement Manager, Oliver Wyman, and Mr. Gaurav Kwatra, Principal, Oliver Wyman. From the presentations of Mr. Lehtonen and Mr. Kwatra, the participants learned that advanced analytics, non-traditional data, natural language processing, together with process digitization, present compelling opportunities for risk management.

August Webinar

(32) Oliver Wyman conducted another webinar for ABA members on “Advanced Analytics for Risk Management” held on August 8, 2018. The webinar was presented by Mikko Lehtonen, an Oliver Wyman Engagement Manager who is based in the Singapore office.

(33) Building on the previous introductory session on advanced analytics that was also cohosted on March 20, 2018 by Mikko, this session provided a more technical view into the application of advanced analytics techniques using Python programming language, Jupiter notebook development environment, and Scikit-learn open source machine learning library. In this session, participants gained an overview of these techniques and will be able to see examples and the application of these techniques in credit modeling, illustrated by practical case studies.

C. ACRAA Training Programs

Bahrain Conference

Bahrain Conference

(34) The Association of Credit Rating Agencies in Asia (ACRAA) invited the ABA to co-organize, along with the European Association of Credit Rating Agencies (EACRA), a one-day Conference on “Showcasing Asian Bond Markets: Opportunities and Risks” held on April 23, 2018 in Bahrain. Invited speakers made presentations on the broad view of the Asian bond markets as well as on the opportunities and risks in the bond markets in selected Asian countries.

Joint ABA-ACRAA Workshop in Taipei

(35) ACRAA and ABA jointly organized the Training Workshop on “Bank Ratings: Methodology and Credit Rating Process and Practice” in Taipei on June 28-29, 2018. With over 50 participants from 8 Asian countries and 24 financial institutions, the two-day program essentially discussed the risk factors considered in the rating of banks, as well as how the latest Basel II and Basel III prescriptions enter into the assignment of credit ratings. It featured six key expert speakers and nine specialized presentations geared towards senior level executives from the Credit, Finance, Investment and Treasury Departments of banks, as well as analysts from Securities and Insurance companies. ACRAA prepared the program and provided the resource speakers and workshop facilitators. The ABA did the organizational work and logistical arrangements, with support and cooperation of the Taiwan Credit Rating Agency.

(36) During the Opening Ceremony, Mr. Ernest Lin, ABA Secretary-Treasurer welcomed all participants to the intensive workshop. Mr. Satoshi Nagakawa, Special Representative for Asia and Special Advisor to the President for Global Strategy, Japan Credit Rating Agency, Ltd. (JCR) and current ACRAA Chairman, followed with his opening remarks highlighting the importance of credit rating in light of recent default cases. The special guest of honor was Cheng Cheng-Mount, Vice Chairman of the Financial Supervisory Commission, who spoke about the importance of this kind of event for banks and financial institutions, as well as the professional upgrade that participants derive from this technical workshop.

Manila Workshop on Infrastructure Projects

(37) ACRAA invited ABA members to attend the Training Workshop on Infrastructure Projects: Their evaluation and Financing be organized by ACRAA on September 6-7, 2018, at the Peninsula Manila Hotel, Makati City, Philippines. ACRAA assembled top-choice speakers for this relevant workshop. Expert speakers from the ADB Risk Management Team, the Philippine PPP Center, international consultants, and CEOs of some of the most active and successful sponsors of infrastructure projects in the Philippines shared with participants their knowledge and experience in dealing with these extremely costly and complex projects. Moreover, ACRAA included a special feature of China’s infrastructure program and their financing.

D. EFMA Summit on Retail Banking

(38) The European Financial Management Association (EFMA) invited ABA members to join the “Retail Banking Summit in Asia 2018” held on October 30-31, 2018 in Singapore. Co-hosted by DBS Group and Maybank, the two-day event focused on the key priorities and most pressing challenges faced by the banking industry in the region. The Summit brought together the most successful banks and companies in the retail financial services ecosystem from Asia and across the world. EFMA offered two complimentary seats to every ABA member bank.

IV Participation in the 51st ADB Annual Meeting in Manila, Philippines

(39) The ABA was once again accredited as Guest Association at the 51st Annual Meeting of the Board of Governors of the Asian Development Bank (ADB) held on May 3-6, 2018 in Manila, Philippines.

(40) During the past 13 years, the ADB has accredited the ABA as a Guest Association in the Annual Meetings of its Board of Directors. ABA members attended the ADB annual gatherings in Yokohama, Japan (2017); Frankfurt, Germany (2016); Baku, Azerbaijan (2015); Astana, Kazakhstan (2014); New Delhi, India (2013);Manila, Philippines (2012); Hanoi, Vietnam (2011); Tashkent, Uzbekistan (2010); Bali, Indonesia (2009); Madrid, Spain (2008); Kyoto, Japan (2007); Hyderabad, India (2006); and Istanbul, Turkey (2005).

(41) The ADB meeting in Manila gathered more than 3,000 registered delegates from some 70 countries. The four-day meeting brought together ministers of finance and development, central bankers, private sector representatives, civil society and media to discuss a broad range of issues linked to ADB’s mission to reduce poverty.

V. 35th ABA General Meeting & Conference

(42) Some 150 bankers from Asia-Pacific, the Middle East and other regions – composed mainly of members of the Asian Bankers Association (ABA) led by ABA Chairman Mr. Daniel Wu, President of the CTBC Financial Holding Co. from Taiwan – gathered in Maldives on November 15-16, 2018 for the 35th ABA General Meeting and Conference. Hosted and organized by Bank of Maldives under the leadership of its Managing Director and CEO Mr. Andrew Healy, the 2018 gathering of ABA members was held at Kurumba Resort. It was the first time that the ABA held its annual gathering of members in Maldives.

(43) This year’s Conference carried the theme “Banking in Asia: The Next Frontier”. The two day event provided another valuable platform for ABA members to meet and network with each other and to exchange views with invited speakers on: (a) current trends and developments in the regional and global markets that are expected to have a significant impact on the banking and financial sector of the region, and (b) how industry players can address the challenges – and take full advantage of the opportunities – presented by these developments.

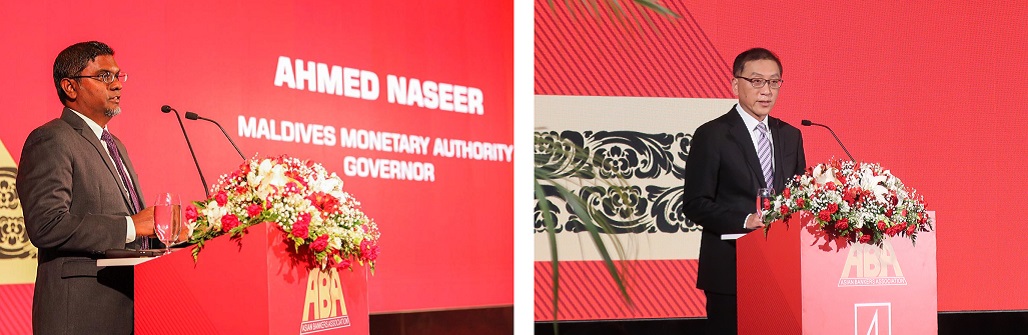

(44) The Keynote Speech was delivered by Mr. Ahmed Naseer, Governor of Maldives Monetary Authority, the country’s central bank. In his address, Governor Naseer stated that Maldives, with its nationwide telecommunication coverage, has reached a milestone of financial inclusion, in the fields of telecommunication and mobile finance payment services. He also noted that the improvements in innovations in regards to cryptocurrency, big data and artificial intelligence (AI) have taken the traditional banking industry to a “whole new level,” adding that “It has allowed financial institutions to be connected to customers, anywhere, anytime through digital channels” Ahmed highlighted the importance to utilize upcoming technologies to break geographical barriers and to address the underserved populations.

(45) Bank of Maldives Managing Director and CEO Mr. Andrew Healy in his Welcome Statement noted that over the past decade, new technologies have dramatically transformed the delivery of financial services. At the same time, incredibly innovative technology firms have catapulted themselves into the financial industry, creating new value and choice for the customers, he added. No one disputes the pressure that exists for traditional banks to adapt and collaborate. But what will be just as critical is managing the risks associated with these new technologies. As we move forward, striking a balance between technological advancement, risk management, and sustainability will be critical.”

(46) ABA Chairman Mr. Daniel Wu in his Opening Statement said that holding the ABA Conference in Maldives provides members a valuable opportunity to gain a better understanding of the country’s market – its economy, its trade and investment potentials, its banking and financial sector, and its people and manpower resources. Furthermore, it serves as an occasion for us to establish contact with important decision makers in business and government, and with the important players in Maldives’ banking and financial industry, thereby helping our members in their effort to seek and identify business opportunities in the country.

(47) The Conference consisted of three Plenary Sessions that featured eminent speakers from both government and the private sector shared their views and insights on the following timely and relevant topics:

(47.a) Plenary Session One focused on the topic “Technology in Banking: The Next Wave” Invited experts examined the potential impact of technology on banks and the probability of disruption in their particular business environment and what changes they need to do on their existing business practices in order not to risk compromising their growth and value.

(47.b) Plenary Session Two addressed the topic “Risk Management Imperatives in the New World Order.” Discussions focused on how industry players can tailor their processes to identify, prioritize, understand and measure emerging and evolving risks, while also understanding their impact and setting in place appropriate monitoring and early warning indicators to mitigate risks as they crystallize.

(47.c) Plenary Session Three tackled the issue “Sustainable Banking: Challenges and Opportunities.” Invited speakers shared their perspectives on how banks can incorporate sustainability principles into corporate strategy funding decisions and product/service definition processes, in order to play an influential role in supporting environmentally and/or socially responsible projects and enterprise.

(48) As in previous years, the two-day event also featured the following special sessions

(48.a) Host Bank session – Organized by Bank of Maldives, this session focused on the topic “Digital Transformation: The Future of Banking.”

(48.b) “Discover ABA” session – This special session featured country presentations by selected ABA member organizations on the economic conditions and current developments and growth prospects in the banking and financial markets of their respective countries, or on special initiatives that have benefited their stakeholders and which be adopted by other member banks. The country presentations were made by representatives from Bank of Maldives; Japanese Credit Rating Agency; Lanka Impact Investing Network; Fintelekt Advisory Service Pvt. Ltd.; Bangko Sentral ng Pilipinas; and Mongolian Bankers Association.

(49) During its Maldives gathering, the ABA also convened the 55th and 56th ABA Board of Directors’ meetings during which they discussed internal policy issues and took action on a number of important matters, including the following:

(49.a) The ABA elected members of the Board of Directors composed of 23 member banks from 15 countries who would serve for the next two years from 2018 to 2020. The member banks that were voted into the Board included the following:

Asian-Based Banks

Bank of Bhutan Bhutan

The Bank of East Asia, Ltd. Hong Kong

State Bank of India India

EN Bank Iran

Bank Pasargad Iran

MUFG Bank, Ltd. Japan

Sumitomo Mitsui Banking Corp. Japan

Mizuho Bank Ltd. Japan

Malayan Banking Berhad Malaysia

Bank of Maldives Maldives

Philippine National Bank Philippines

Rizal Commercial Banking Corp. Philippines

DBS Bank Singapore

Hatton National Bank Ltd. Sri Lanka

Bank of Taiwan Taiwan

CTBC Bank Taiwan

First Commercial Bank Taiwan

Bangkok Bank, Ltd. Thailand

The Bank for Foreign Trade of Vietnam Vietnam

Vietnam Bank for Agriculture and Rural Development Vietnam

Multinational Banks with Asian Presence

Erste Group Bank (HK) Austria

(49.b) The newly elected Board elected Mr. Jonathan Alles, Managing Director and CEO of Hatton National Bank from Sri Lanka, as Chairman for 2018-2020. Mr. Mohamed Shareef, Deputy CEO and Director of Operations at Bank of Maldives, was named Vice Chairman.

(49.b) The ABA adopted its 2018-2020 Work Program outlining activities over the next two years in the area of policy advocacy, information exchange, training and professional development, strengthening relationship with other regional and international organizations, and membership expansion.

(49.c) The ABA also admitted The Export Development Bank of Iran and Tamadon Investment Bank as its newest regular members.

(50) The ABA also convened a meeting of the ABA Policy Advocacy Committee, which discussed policy issues of concern to the banking sector and planned out its activities for the next two years. Among others, as part of its policy advocacy work, the ABA:

(50.a) Considered the paper on the project conducted by CSR Lanka with the Durham University UK on the “South/Southeast Asian Business Society Models “focusing on sustainable SMEs.

(50.b) Considered the paper sharing the Bank’s experience in Islamic banking, particularly in promoting cooperation among relevant regulatory authorities, among banking units within both conventional and Islamic banking systems, and among Islamic banking system units and supervisory bodies in Islamic banking and conventional banking activities.

(50.c) Considered the paper on the security measures and techniques set in place by Hatton National Bank from Sri Lanka to help prevent, detect or disrupt a cyber attack on its operations.

(50.d) Considered the paper on the experiences of financial institutions in South Asia and Southeast Asia in facing the cross-border challenges of AML/CFT compliance requirements, and what actions have been taken by them to execute the implementation throughout their respective organizations.

(50.e) Exchanged views on possible issues for future policy advocacy work of ABA.

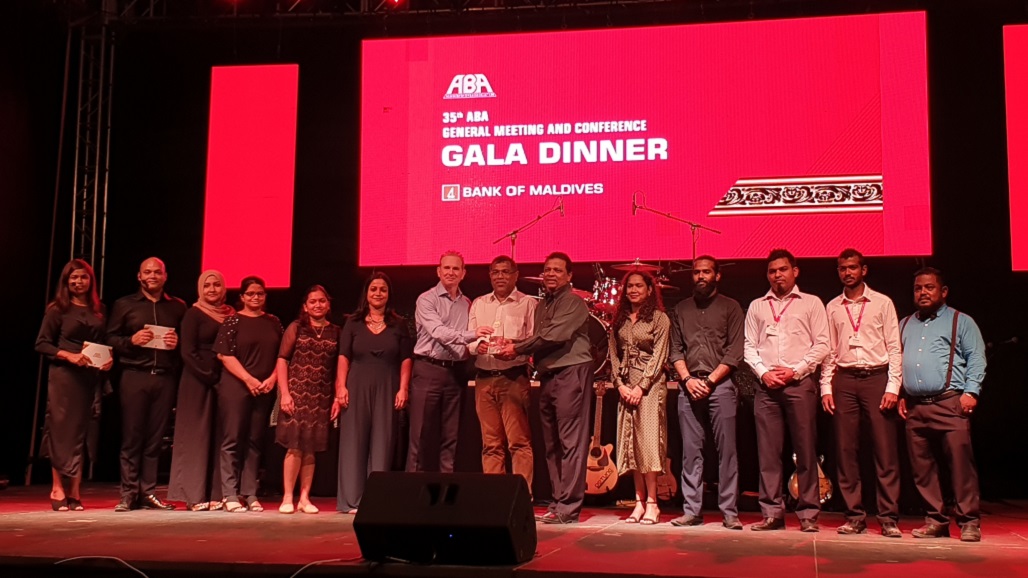

(51) During the Gala Dinner, the ABA gave recognition to its members who have demonstrated their strong support for and commitment to the objectives of ABA. Certificates of appreciation were presented to the following:

(51.a) Representatives of ABA Board members who attended more than five annual meetings of the ABA since 2008. The awardees included:

- Daniel Wu, ABA Chairman

- Susan Chang, Member, Advisory Council

- Rajendra Theagarajah, Member, Advisory Council

- Peter Yuen, Bank of East Asia Ltd.

- Dilshan Rodrigo, Hatton National Bank

- Vahid Soud, EN Bank

- Nghiem Xuan Thanh, Vietcombank

- Mostafa Beheshti Rouy, Bank Pasargad

- Thanatphong Pratheepthaweephon, Bangkok Bank

- Shing Shiang Ou, Bank of Taiwan

(51.b) Officers of member banks who served as Chairman of the ABA Policy Advocacy Committee during the 2008-2018 period. The awardees were:

- Shing-Shiang Ou, Bank of Taiwan (2008 – 2010

- Dilshan Rodrigo, Hatton National Bank (2010 – 2012)

- Elbert Zosa, Rizal Commercial Banking Corp. (2012 – 2014)

- Prudence Lin, CTBC Bank (2014 – 2018)

(51.c) Member banks who hosted ABA Short-Term Visiting Programs over the past ten years. The awardees included:

Malayan Banking Berhad

Malayan Banking Berhad- Rizal Commercial Banking Corp.

- Sumitomo Mitsui Banking Corporation

- Hatton National Bank

- State Bank of India

- United Overseas Bank Ltd.

- CTBC Bank

(52) The ABA presented a Distinguished Service Award to Mr. Dong-Soo Choi in recognition of his outstanding accomplishments, as Chairman of the Asian Bankers Association (ABA) from 2004 to 2006 and as Chairman of the ABA Advisory Council since 2013, in serving the interest of ABA member banks and the Asia-Pacific banking and financial community as a whole, and for his valuable contribution in promoting the growth and development of the Association. Mr. Choi has retired as the Advisory Council Chairman and has been replaced by the Immediate Past ABA Chairman Mr. Daniel Wu.

VI. Other activities

A. Meeting with ABA Members

Khan Bank

Khan Bank

(53) ABA Secretary-Treasurer Mr. Ernest Lin and Deputy Secretary Mr. Amador Honrado on September 8 visited the new headquarters of Khan Bank in Ulaanbaatar, Mongolia and met with Ms. Ganbyamba.Sh, Director of Human Resources; Ms. Oyuntsetseg Ts., Head of Public Relations Dept.; Ms. Tungalagtamir D, Senior Officer, Public Relations Department; and Ms. Solongo. S., Head of Training and Development Department. They exchanged views on possible activities where their respective organization can cooperate with each other, particularly in the area of training and capacity building. The ABA Secretariat officers also invited Khan Bank to make a country presentation at the “Discover ABA” session of the 35th ABA General Meeting and Conference to be held on November 15-16, 2018 in Maldives.

Mongolian Bankers Association

Mongolian Bankers Association

(54) Mr. Unendat Jigjid, Executive Director and Secretary-General of the Mongolian Bankers Association (MBA), and Ms. Ariunaa Erdene-Ochir, Manager, Foreign Relations and Partnership of MBA, on September 8 received ABA Secretary-Treasurer Mr. Ernest Lin, Deputy Secretary Mr. Amador Honrado, and Senior Officer Ms. Wendy Yang at the MBA office in Ulaanbaatar. They discussed areas of cooperation between the two organizations, particularly in identifying ABA member banks and other strategic partners which may be tapped to provide training for MBA members. The ABA Secretariat officers also requested MBA to encourage their members to attend the 35th ABA General Meeting and Conference in Maldives in November.

Banks Association of Turkey

(55) ABA Secretary-Treasurer Mr. Ernest Lin and Deputy Secretary Mr. Amador Honrado on November 22 met with Dr. Ekrem Keskin, Secretary General of the Banks Association of Turkey (BAT), and Mr. Ali Gungor, Coordinator, at the Istanbul office of the Association. The ABA Secretariat executives updated Dr. Keskin and Mr. Gungor on the ongoing and upcoming activities of the ABA. They also explored with the BAT officers on the possibility of holding the 2019 ABA Conference in Istanbul to be hosted by BAT.

(55) ABA Secretary-Treasurer Mr. Ernest Lin and Deputy Secretary Mr. Amador Honrado on November 22 met with Dr. Ekrem Keskin, Secretary General of the Banks Association of Turkey (BAT), and Mr. Ali Gungor, Coordinator, at the Istanbul office of the Association. The ABA Secretariat executives updated Dr. Keskin and Mr. Gungor on the ongoing and upcoming activities of the ABA. They also explored with the BAT officers on the possibility of holding the 2019 ABA Conference in Istanbul to be hosted by BAT.

B. Creation of LinkedIn Page

(56) The ABA created its own LinkedIn account as additional social media platform for disseminating information to both members and non-members alike and for encouraging discussion and dialogue on issues of common concern.

C. Publication of the 2017 Year-End Report

(57) The ABA Secretariat issued the 2017 Year-End Report summarizing the major activities of ABA in 2017.

D. Publication of the Monthly ABA Newsletter

D. Publication of the Monthly ABA Newsletter

(58) The ABA Secretariat continued issuing to members the monthly ABA Newsletter, sharing the latest news and developments in member banks and on current policies that might have significant impact on the banking and financial sector of the region.

Leave a Reply